Quarterly Financial Report for the quarter ended September 30, 2021

(unaudited)

ISSN 2817-2949

Cat. No. FD3-3E-PDF

1. Introduction

This quarterly report has been prepared by management as required by section 65.1 of the Financial Administration Act, and in the form and manner prescribed by the Treasury Board in the Directive on Accounting Standards, GC 4400 Departmental Quarterly Financial Reports. This Quarterly Financial Report should be read in conjunction with the 2021–22 Main Estimates for the Financial Transactions and Reports Analysis Center of Canada (FINTRAC).

This quarterly financial report has not been subject to an external audit or review.

1.1. Authority, Mandate and Program Activities

FINTRAC (the Centre) is Canada's financial intelligence unit and anti-money laundering and anti-terrorist financing regulator. The Centre assists in the detection, prevention and deterrence of money laundering and the financing of terrorist activities. FINTRAC's financial intelligence and compliance functions are a unique contribution to the safety of Canadians and the integrity of Canada's financial system.

FINTRAC acts at arm's length and is independent from the police services, law enforcement agencies and other entities to which it is authorized to disclose financial intelligence. It reports to the Minister of Finance, who is in turn accountable to Parliament for the activities of the Centre. FINTRAC is headquartered in Ottawa, with regional offices located in Montréal, Toronto, and Vancouver.

FINTRAC was established by, and operates within the ambit of, the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) and its Regulations. The Centre is one of several domestic partners in Canada's Anti-Money Laundering and Anti-Terrorist Financing Regime, which is led by the Department of Finance.

FINTRAC fulfills its mandate by engaging in the following activities:

- Receiving financial transaction reports and voluntary information in accordance with the legislation and regulations;

- Safeguarding personal information under its control;

- Ensuring compliance of reporting entities with the legislation and regulations;

- Maintaining a registry of money services businesses in Canada;

- Producing financial intelligence relevant to investigations of money laundering, terrorist activity financing and threats to the security of Canada;

- Researching and analyzing data from a variety of information sources that shed light on trends and patterns in money laundering and terrorist activity financing; and

- Enhancing public awareness and understanding of money laundering and terrorist activity financing.

In addition, FINTRAC is part of the Egmont Group, an international network of financial intelligence units that collaborate and exchange information to combat money laundering and terrorist activity financing. FINTRAC also contributes to other multilateral fora such as the Financial Action Task Force (FATF), the Asia-Pacific Group on Money Laundering (APG) and the Caribbean Financial Action Task Force (CFATF), participating in international policy making and the provision of technical assistance to other FIUs.

The description of the program activities for the Centre can be found in Part II of the 2021–22 Main Estimates and in the 2021–22 Departmental Plan (DP).

1.2. Basis of Presentation

This Quarterly Financial Report has been prepared by management using an expenditure basis of accounting, and a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities. The accompanying Statement of Authorities includes the Centre's spending authorities granted by Parliament and those used by the Department, consistent with the Main Estimates and Supplementary Estimates for both fiscal years as well as transfers from Treasury Board central votes that are approved by the end of the quarter.

The authority of Parliament is required before monies can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

FINTRAC uses the accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental performance reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

2. Highlights of Fiscal Quarter and Fiscal Year-to-Date (YTD) Results

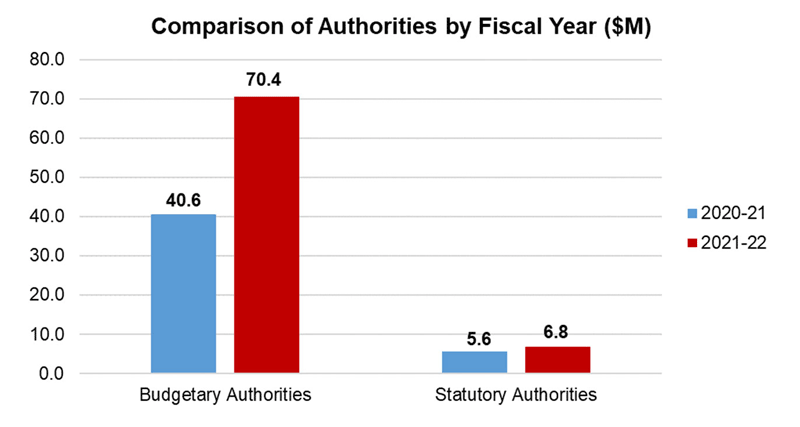

This departmental quarterly financial report reflects the results of the current fiscal period. The following graph provides a comparison of budgetary and statutory authorities available for the first three months of 2021–22 compared to 2020–21.

2.1. Authorities Analysis

The following table provides a comparison of cumulative authorities by vote for the current and previous fiscal years.

| Authorities Available (in thousands) |

2021–22 | 2020–21 | Variance ($) | Variance (%) |

|---|---|---|---|---|

| Budgetary | ||||

| Voted | ||||

| Vote 1 – Program Authorities | 70,428 | 40,556 | 29,872 | 74% |

| Statutory | ||||

| Employee Benefits Plan | 6,840 | 5,620 | 1,220 | 22% |

| Total Budgetary authorities | 77,268 | 46,176 | 31,092 | 67% |

| Non-budgetary | 0 | 0 | 0 | 0% |

| Total authoritiesFootnote 1 | $77,268 | $46,176 | $31,092 | 67% |

2.1.1. Voted Budgetary Authorities

The total Vote 1 program authorities available as at September 30, 2021 are $70.4 million compared to $40.6 million for the same period in 2020–21. The increase of $29.9 million or 74% is attributable to the following factors:

- An increase of $13.3 million in funding announced in the Economic and Fiscal Snapshot 2020 for fighting financial crime, relocating FINTRAC's headquarters and modernizing the cross-border currency reporting framework;

- An increase of $12.8 million due to a timing difference in the approval of the full supply of the Main Estimates compared to last fiscal year. The full supply for the Main Estimates was approved as of the close of the first quarter for 2021–22, compared to 9/12ths of full supply during the first quarter of 2020–21 due to the COVID-19 pandemic;

- An increase of $2.5 million in personnel funding for an approved annual cost of living increase;

- An increase of $0.6 million in personal funding following an approved reprofile request to support the human resources function;

- An increase of $0.4M based on the profile of funding announced in Budget 2019 to strengthen Canada anti-money laundering and anti-terrorist financing regime;

- An increase of $0.2M attributable to variances in transfers to other government departments for services provided to FINTRAC; and

- A decrease of $0.1M in the profile of funding to contribute to the national strategy to combat human trafficking.

2.1.2. Statutory Budgetary Authorities

The total statutory authorities available as at September 30, 2021 are $6.8 million compared to $5.6 million for the same period in 2020–21. The increase of $1.2 million or 22% is attributable to the following factors:

- An increase of $1.4 million in employee benefits plan (EBP) funding based on the profile of funding announced in Budget 2019 and the Economic and Fiscal Snapshot 2020.

- An increase of $0.4 million in EBP funding related to an increase in personnel funding for an approved annual cost of living increase; offset by

- A decrease of $0.6 million due to adjustments to EBP funding.

2.2. Expenditure Analysis

The following table provides a comparison of year-to-date spending as at September 30 by vote for the current and previous fiscal years.

| Year-to-date expenditures (in thousand $) |

2021–22 | 2020–21 | Variance ($) |

Variance (%) |

|---|---|---|---|---|

| Budgetary | ||||

| Voted | ||||

| Vote 1 – Program Expenditures | 29,674 | 23,920 | 5,754 | 19% |

| Statutory | ||||

| Employee Benefits Plan | 3,420 | 2,810 | 610 | 18% |

| Total Budgetary expenditures | 33,094 | 26,730 | 6,364 | 19% |

| Non-budgetary | 0 | 0 | 0 | 0% |

| Total year-to-date expendituresFootnote 2 | $33,094 | $26,730 | $6,364 | 19% |

2.2.1. Voted Budgetary Expenditures

Total voted expenditures were $29.7 million in 2021–22 compared to $23.9 million in 2020–21, an increase of $5.8 million or 19%. The net increase is the result of the following variances in expenditure categories:

- Personnel expenditures increased by $2.9 million following an increase in hiring and the implementation of an approved annual cost of living increase.

- Expenditures for professional and special services increased by $1.6 million primarily due to expenses related to information technology consulting.

- Rental expenses increased by $0.8 million following an increase in license and maintenance fees for client and application software.

- Transportation and communication expenses increased by $0.5 million following an increase in data communication services.

- A $0.2 million increase in information expenditures for electronic subscriptions, database access and media monitoring services.

- Expenditures in purchase, repair and maintenance decreased by $0.1 million due to a reduction of computer equipment purchases.

2.2.2. Statutory Budgetary Expenditures

Statutory expenditures increased by $0.6 million or 18% from $2.8 million during the first quarter of 2020–21 to $3.4 million in 2021–22. This variance is due to an increase in Employee Benefits Program (EBP) expenses as a result of increased personnel expenditures.

3. Risks and Uncertainties

As Canada's financial intelligence unit and a partner in Canada's Anti-Money Laundering and Anti-Terrorist Financing Regime, FINTRAC operates in a dynamic, constantly changing environment. In seeking to identify risks and opportunities proactively, FINTRAC must anticipate and assess internal and external risk factors that can affect the design and delivery of its programs and the achievement of its strategic objectives. Additionally, FINTRAC must identify factors and risks that could adversely affect its ability to manage its resources effectively. FINTRAC maintains a Corporate Risk Profile (CRP) to identify and manage its key corporate risks. Senior level committees review the CRP regularly and the business planning process identifies activities to mitigate the risks. In 2020–21, FINTRAC updated its CRP to provide a more robust risk context, which will help the Centre in identifying, analyzing and assessing key uncertainties (risks) that may limit FINTRAC's achievement of its objectives now or in the future. The objective of the CRP is to create information that FINTRAC managers and decision makers can use when planning and setting priorities. In addition, there remains some uncertainty due to the need to manage within the ongoing public health pandemic, which has had an impact on the timing of planned initiatives and related expenditures. Due to this anomaly, year over year expenditure trends may not be as informative as in previous annual cycles.

3.1. Risk Factors and Mitigation

One area of risk identified in FINTRAC's current CRP is limited capacity. As a small organization, FINTRAC faces challenges and limitations regarding its human resources capacity and its flexibility to cash manage funds. Employee engagement at all levels, along with appropriate talent and tools, is required to ensure effective resource management. As well, effective management of resources through periods of transformation is critical to ensure effective alignment of resources and to seize investment opportunities as they materialize.

Another area of risk highlighted in FINTRAC's CRP relates to the Centre's risk that legacy IM/IT hardware and software capacity will limit FINTRAC's ability to achieve its objectives. FINTRAC depends on a sophisticated information technology infrastructure to receive, store and secure approximately 30 million new financial transaction reports every year. At the same time, this infrastructure allows intelligence analysts to filter the information, analyze it, and generate actionable financial intelligence for Canada's police, law enforcement and national security agencies. This is only possible with modern systems and processes that can manage the high volume of information, make the connections and produce the needed results, all in real-time or close to it. FINTRAC continues to ensure that its business systems and processes support its ability to deliver on its mandate and to adapt to future innovations and enhancements in business requirements.

Finally, FINTRAC's IT infrastructure is a Shared Services Canada (SSC) asset. This infrastructure is aging, which could potentially have an impact on FINTRAC operations and security requirements. With competing priorities from various partner departments, and a strategic focus toward end-state services, SSC has limited funding available for legacy infrastructure. This places an additional pressure on the Centre (which has provided supplemental funding for essential initiatives) to effectively plan, allocate its resources and deliver on its programs. To mitigate, FINTRAC staff are working with SSC to update operating systems and to replace custom software with suitable Commercial Off-the-Shelf (COTS) solutions, which are secure, reliable and regularly updated by suppliers. In addition, the Centre has advanced Digital Strategy activities that includes speeding up core business through digital automation, and advanced analytics. Lastly, FINTRAC is examining enhanced solutions including information sharing across database systems and implementing advanced data analytics to increase the capability of current systems to meet anticipated increased demands.

4. Significant Changes in Relation to Operations, Personnel and Programs

4.1. Key Personnel Changes

There were no personnel changes at the senior management level during the second quarter of 2021–22.

4.2. Changes in Funding

Budget 2019 directed resources (up to $20.5 million over 5 years) to FINTRAC to strengthen Canada's anti-money laundering and anti-terrorist financing regime. The funding supports the following five initiatives: the implementation of legislation and regulations package 2; trade based money laundering (TBML) analysis; disclosing to Revenue Quebec and the Competition Bureau; strengthening FINTRAC compliance outreach and examinations; and expanding FINTRAC public-private partnership projects. FINTRAC's 2021–22 funding for these initiatives is $4.7 million (excluding $0.6 million in EBP). This is an increase of $0.4 million from 2020–21 authorities of $4.3 million (excluding $0.5 million in EBP).

FINTRAC received funding in an off-cycle funding announcement to contribute to the national strategy to combat human trafficking ($2.2 million over 5 years). 2021–22 funding for this initiative is $0.5 million (excluding $0.1 million in EBP). This is a decrease of $0.1 million from 2020–21 authorities of $0.6 million (excluding $0.1 million in EBP).

The Economic and Fiscal Snapshot of July 8, 2020 announced funding for FINTRAC (up to $130.5 million over 5 years) for fighting financial crime, relocating FINTRAC's headquarters and modernizing the cross-border currency reporting framework. FINTRAC's 2021–22 funding for these initiatives is $13.3 million (excluding $1.3 million in EBP).

5. Approval by Senior Officials

Approved by:

Annette Ryan, Acting Director and CEO

Date: December 3, 2021

Christopher Veilleux, Acting Chief Financial Officer

Date: December 2, 2021

| Fiscal Year 2021–22 | Fiscal Year 2020–21 | |||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 2022 Footnote 3 | Used during the quarter ended September 30, 2021 | Year-to-date used at quarter-end | Total available for use for the year ending March 31, 2021 Footnote 4 | Used during the quarter ended September 30, 2020 | Year-to-date used at quarter-end | |

| Budgetary authorities | ||||||

| Vote 1 – Program expenditures | 70,428 | 17,973 | 29,674 | 40,556 | 14,011 | 23,920 |

| Budgetary statutory authorities | ||||||

| Contributions to employee benefit plans | 6,840 | 1,710 | 3,420 | 5,620 | 1,405 | 2,810 |

| Total budgetary authorities | 77,268 | 19,684 | 33,094 | 46,176 | 15,416 | 26,730 |

| Non-budgetary authorities | 0 | 0 | 0 | 0 | 0 | 0 |

| Total authorities Footnote 5 | $77,268 | $19,684 | $33,094 | $46,176 | $15,416 | $26,730 |

| Expenditures | Fiscal Year 2021–22 | Fiscal Year 2020–21 | ||||

|---|---|---|---|---|---|---|

| Planned expenditures for the year ending March 31, 2022Footnote 6 | Expended during the quarter ended September 30, 2021 |

Year-to-date used at quarter-end | Planned expenditures for the year ending March 31, 2021Footnote 7 | Expended during the quarter ended September 30, 2020 |

Year-to-date used at quarter-end | |

| Personnel | 53,169 | 13,570 | 25,347 | 44,141 | 11,393 | 21,878 |

| Transportation & communications | 1,810 | 503 | 514 | 1,434 | 34 | 49 |

| Information | 454 | 210 | 299 | 452 | 99 | 118 |

| Professional & special services | 9,785 | 2,165 | 2,920 | 4,094 | 1,067 | 1,277 |

| Rentals | 6,251 | 2,694 | 3,236 | 6,972 | 2,300 | 2,461 |

| Repair & maintenance | 878 | 202 | 223 | 308 | 289 | 334 |

| Utilities, materials & supplies | 404 | 77 | 125 | 437 | 36 | 121 |

| Acquisition of land, buildings & works | 0 | 0 | 0 | 0 | 0 | 0 |

| Acquisition of machinery & equipment | 4,476 | 259 | 424 | 1,091 | 181 | 472 |

| Transfer payments | 0 | 0 | 0 | 0 | 0 | 0 |

| Other subsidiaries & payments | 41 | 4 | 6 | 44 | 17 | 20 |

| Total budgetary expenditures Footnote 8 | $77,268 | $19,684 | $33,094 | $58,973 | $15,416 | $26,730 |

- Date Modified: