Alternative to large cash transaction reporting

Financial entities i.e., banks, credit unions, caisses populaires, trust companies, loan companies or agents of the Crown that accept deposit liabilities, may be able to choose an alternative to sending Large Cash Transaction Reports about transactions for certain clients that are corporations.

This is not available to any other reporting entity.

FINTRAC’s multi-year initiative to implement important changes to its reporting forms

- Modernizing FINTRAC's reporting forms Updated on April 8, 2024

- Schedule to implement changes to FINTRAC’s reporting forms Updated on April 19, 2024

- Draft documents to help you prepare for changes to FINTRAC’s reporting forms Updated on April 19, 2024

How to transmit the report

I use BATCH to report

If you use the batch file transfer reporting mechanism, use your batch transmission software to submit your Financial Entity Business Client Report to FINTRAC. You will have to notify FINTRAC that your batch transmission software has to support this type of report.

If you do not already transmit reports by batch, go to Option 2: I do not use Batch to report.

Submit your first Financial Entity Business Client Report to FINTRAC

Step 1

Download and save a copy of the Financial Entity Business Client Report spreadsheet for batch transmission. To do this, right-click on the appropriate link below and select Save Target As...

- Financial Entity Business Client Report for Microsoft Excel (47 kb)

- Financial Entity Business Client Report for Quattro Pro (44 kb)

- Financial Entity Business Client Report for Lotus 1-2-3 (61 kb)

Step 2

Complete the Financial Entity Business Client Report spreadsheet according to the instructions in Guideline 9: Alternative to Large Cash Transaction Reports to FINTRAC.

Step 3

Once you have completed the spreadsheet, save it in its default format (i.e., xls, qpw or wk4) for future reference and updating.

Step 4

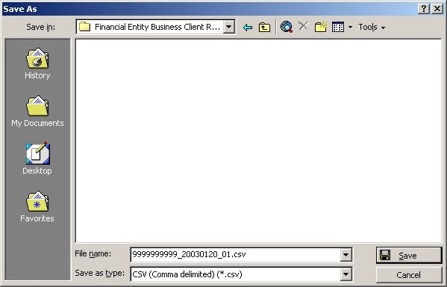

Before you submit the file to FINTRAC, save it again in a comma separated value format (i.e., with a ".csv" extension). Only this copy is to be sent to FINTRAC.

To save your file in a comma separated value format, open the completed Financial Entity Business Client Report spreadsheet. Go to the File menu and select Save As. In the File name section, follow the format PKIUSERID_YYYYMMDD_##.csv, and substitute each element as follows:

- PKIUSERID is your 10-digit PKI User ID number issued by FINTRAC.

- YYYYMMDD is the date the file is sent to FINTRAC (i.e., the current date).

- ## is a two-digit number to differentiate between reports. Use "01" unless you send more than one Financial Entity Business Client Report within the same day. If you do send more than one report in the same day, then increment "##" accordingly (i.e., 01, 02, etc.).

- csv is the file extension of the spreadsheet to be submitted (i.e., for a comma separated value or comma delimited format, the extension is "csv").

When selecting which file type to save as, choose one of the following:

- In Microsoft Excel, select CSV (Comma delimited) (*.csv).

- In Quattro Pro, select CSV (Comma delimited).

- In Lotus 1-2-3, select Comma Separated Value (CSV).

Example of the "Save As" Window in Microsoft Excel

Step 5

Once the file has been saved in a comma separated value format, submit it to FINTRAC with your batch transmission software provided to you by FINTRAC. Remember that you have to first notify FINTRAC that you will be sending this type of report by batch.

Use the batch report channel called Alt to LCTR (alternative to large cash transaction reports) to drop the spreadsheet for transmission. Please refer to the Batch Transmitter Guide for more information about the transmission of files.

You will be notified if the transmission of the file was successful. However, you will not receive a secondary acknowledgement about processing results.

I do not use BATCH to report (report by fax)

If you do not use the batch file transfer reporting mechanism, you can submit your Financial Entity Business Client Report to FINTRAC by fax. Once you have completed the spreadsheet, you should save it for future reference and updating.

Submit your first Financial Entity Business Client Report to FINTRAC

Step 1

Download and save a copy of the Financial Entity Business Client Report spreadsheet for non-batch transmission. To do this, right-click on the appropriate link below and select Save Target As...

- Financial Entity Business Client Report for Microsoft Excel

- Financial Entity Business Client Report for Quattro Pro

- Financial Entity Business Client Report for Lotus 1-2-3

Step 2

Complete the Financial Entity Business Client Report spreadsheet according to the instructions in Guideline 9: Alternative to Large Cash Transaction Reports to FINTRAC.

Step 3

Once you have completed the spreadsheet, save it for future reference and updating. As this file is for your own records, the file naming convention is up to you.

Step 4

Print the file and send to FINTRAC by fax at 1-866-226-2346.

Reporting instructions

How to add new clients to your Financial Entity Business Client Report

If you have sent a Financial Entity Business Client Report before and you need to add new business clients, start with the spreadsheet you saved in its default format the last time you sent your Financial Entity Business Client Report to FINTRAC. Indicate that this is an update to a previously submitted report in the area above Part A. Also, enter "A" in the "Update indicator" column to the left of field B1 for each new business client to be added. Once you have finished adding the information for each one to your spreadsheet, follow the steps for sending a first report, as of Step 3.

How to report certain changes about the client

Once the information about business clients has been sent to FINTRAC in your Financial Entity Business Client Report, if there are any changes to the client's name or address, the nature of the client's business or the business incorporation number, you have to report the change to FINTRAC. This has to be done within 15 calendar days after the change is made.

To report these types of changes to FINTRAC, start with the spreadsheet you saved in its default format the last time you sent your Financial Entity Business Client Report to FINTRAC.

Indicate that this is an update to a previously submitted report by entering "U" in the area above Part A. Also, enter "C" in the "Update Indicator" column to the left of field B1 for each business whose information is being changed. Do not complete Part D, as this is only applicable to the annual verification.

Re-save the spreadsheet and submit it in its entirety to FINTRAC, according to the batch transmission or fax instructions that apply to you. Repeat this process any time you have to report a change.

How to report the annual verification?

Once you have chosen the alternative to large cash transaction reports, you have to verify at least once every 12 months that all the conditions listed in Section 2.1 of Guideline 9: Alternative to Large Cash Transaction Reports to FINTRAC are still met for each client. Once this is done, you have to complete Part D of your Financial Entity Business Client Report and send it to FINTRAC to provide the name of your senior officer who has confirmed that the conditions are still being met for a particular client.

To do this, you will need to start with your latest "saved copy" of your spreadsheet. Indicate that this is an annual verification by entering a "V" in the area above Part A. Also, enter "V" in the "Update indicator" column to the left of field B1 for each business whose information is being verified and complete Part D for each one.

Please do not include any new business clients and do not make any changes to information in Parts A, B or C on the report at the time of your annual verification. If you need to add new business clients or make changes, do so by submitting the related information as an update as described in the links above.

- Date Modified: