2022–23 Annual Report

Safe Canadians, Secure Economy

On this page

- 2022–23 highlights

- Message from the Director and CEO

- FINTRAC's mandate

- Protecting the safety of Canadians

- Enhancing awareness of money laundering and terrorist financing

- Safeguarding Canada's financial system

- Global leadership

- Protecting personal information

- Modernizing and strengthening FINTRAC

- Annex A: The value of FINTRAC disclosures

- Annex B: Project Anton – A sanitized case

- Annex C: Financial transaction reports

"In September 2022, the Alberta Law Enforcement Response Teams recognized FINTRAC’s assistance in a complex multi-jurisdictional investigation called Project Cobra. This investigation resulted in the seizure of 928 kilograms of methamphetamine and 6 kilograms of cocaine, and the laying of 80 charges against 15 people, including in relation to laundering the proceeds of crime, participation in a criminal organization and drug trafficking. It’s not hard to imagine the harm that these drugs would have done in our communities."

View text equivalent for the Project Cobra poster

This poster depicts the contribution that FINTRAC's financial intelligence made in Project Cobra.

FINTRAC's financial intelligence was recognized by ALERT Calgary in relation to an organized crime investigation into transnational drug importation, drug trafficking, and money laundering.

Project Cobra, a nearly three-year investigation, relied on the assistance of numerous police agencies and specialized units. As a result of enforcement initiatives on both sides of the border, the following was seized or placed under criminal restraint:

- $55 million of methamphetamine and cocaine

- $7 million of property, bank accounts, luxury vehicles, and other suspected proceeds of crime

- 19 firearms including handguns, rifles, submachine guns, and suppressors

Charges included:

15 people and 1 business charged with 80 criminal offences

- Participation in a criminal organization

- Importation of a controlled substance

- Laundering proceeds of crime

- Drug trafficking

Partners: ALERT Calgary, Calgary Police Service, Edmonton Police Service, U.S. Homeland Security Investigations, U.S. Customs and Border Protection, Canada Border Services Agency, Niagara Regional Police, Canada Revenue Agency, Royal Canadian Mounted Police, and Financial Transactions and Reports Analysis Centre of Canada

Quote from ALERT Superintendent Marc Cochlin: "We've heard the saying 'cutting the head off the snake' in order to cripple a criminal network, well, Project Cobra didn't just cut off the head of the snake; these dedicated men and women took (out) the whole damn snake."

2022–23 highlights

Protecting the safety of Canadians

- 2,085

financial intelligence disclosures to law enforcement and national security agencies - Launched Project Legion,

a new public-private partnership to combat the laundering of proceeds related to illicit cannabis activities - Contributed to

292

major, resource intensive investigations across Canada and many hundreds of other individual investigations at the municipal, provincial and federal levels throughout the country - 96%

of feedback from domestic law enforcement and national security agencies indicated the Centre's financial intelligence was valuable and actionable

Safeguarding Canada's financial system and economy

- Conducted

193

engagement activities with businesses and stakeholders across Canada - Issued guidance to help survivors of human trafficking for sexual exploitation access banking services under the global Finance Against Slavery and Trafficking Survivor Inclusion Initiative

- Conducted

237

compliance examinations across the country - Revoked the registration of

81

money services businesses - Issued

6

Notices of Violation for non-compliance to businesses - Provided

10

Non-Compliance Disclosures to law enforcement

Global leadership

- Provided

225

financial intelligence disclosures to foreign financial intelligence units - 100%

of the feedback received from 25 foreign financial intelligence units indicated they were mostly or very satisfied with FINTRAC's financial intelligence - Worked with allies to establish the Russia-Related Sanctions and Illicit Finance Financial Intelligence Units Working Group

- Launched Project Anton, an international public-private partnership to combat the laundering of proceeds related to illegal wildlife trade

- Played a leadership role in the Global Coalition to Fight Financial Crime with FINTRAC's Director and CEO co-chairing the Financial Intelligence Unit and Law Enforcement Sub-Group

- Provided key support to the Egmont Group including through FINTRAC's Director and CEO chairing the Egmont Information Exchange Working Group

- Supported the Financial Action Task Force (FATF), including collaborating on numerous policy and research documents such as FATF's study on Illicit Proceeds Generated from the Fentanyl and Related Synthetic Opioids Supply Chain

Modernizing and strengthening FINTRAC

- Strengthened

FINTRAC's focus on recruitment, leadership development, talent management and employee learning and training - Finalized

a new Employment Equity, Diversity and Inclusion Strategy and Action Plan - Implemented

FINTRAC's multi-year Digital Strategy aimed at transforming the Centre into a leading digital organization - Modernizing

Compliance and HR programs, processes and systems

Enhancing awareness of money laundering and terrorist financing

- Published

a new Sectoral and Geographic Advisory, Underground Banking through Unregistered Money Services Businesses - Launched

new Operational Alerts, Laundering of Proceeds from Illicit Cannabis Activities, Terrorist Activity Financing and Laundering the Proceeds of Crime from Illegal Wildlife Trade

Message from the Director and CEO

I am proud to share with Canadians the real and impactful results that FINTRAC delivered in 2022–23 as Canada's Financial Intelligence Unit and Anti-Money Laundering and Anti-Terrorist Financing Supervisor.

FINTRAC continues to operate in a challenging environment with new and evolving technologies and financial products, rapidly shifting global financial systems, and geopolitical events constantly shaping our work. Our role in detecting, preventing and deterring money laundering and the financing of terrorist activities is more critical than ever as criminals and terrorists are using increasingly sophisticated methods and professional facilitators to exploit vulnerabilities and take advantage of any opportunity to enrich themselves and advance their illicit enterprises.

Over the past year, we played a key role in helping to protect the safety of Canadians, particularly Canada's most vulnerable citizens and communities. With the information that we receive from Canadian businesses, we were able to generate 2,085 unique financial intelligence disclosures in support of money laundering and terrorist financing investigations across Canada and around the world. Our financial intelligence contributed to 292 major, resource intensive investigations last year, and many hundreds of other individual investigations at the municipal, provincial and federal levels across the country, and internationally. I was pleased to see that 96% of the feedback that we received from domestic law enforcement and national security agencies indicated that our financial intelligence was both valuable and actionable.

Our financial intelligence often contains thousands of financial transaction reports in each disclosure, which speaks to the complexity of connecting the flow of illicit funds involving organized criminal groups. Our disclosures are also regularly provided to a number of agencies simultaneously when we have the authorization to do so. Our ability to provide multiple disclosure packages means that we can help Canada's law enforcement and national security agencies connect criminal activities and operations across a number of domestic and international jurisdictions by following the money.

In September 2022, the Alberta Law Enforcement Response Teams recognized FINTRAC's assistance in a complex multi-jurisdictional investigation called Project Cobra. This investigation resulted in the seizure of 928 kilograms of methamphetamine and 6 kilograms of cocaine, and the laying of 80 charges against 15 people, including in relation to laundering the proceeds of crime, participation in a criminal organization and drug trafficking. It's not hard to imagine the harm that these drugs would have done in our communities.

Over the past year, we also helped safeguard Canada's financial system and economy by assisting and ensuring the compliance of thousands of businesses with the Proceeds of Crime (Money Laundering) and Terrorist Financing Act and Regulations. In addition to responding to approximately 11,000 enquiries from entities across the country, we participated in nearly 200 engagement activities with businesses and their associations, including hosting a Banking Forum for representatives from industry and partner agencies. We also focused on developing modern new tools to help businesses better understand how they can meet their obligation to verify the identity of their clients.

At the same time, we continued to take a broad approach to ensuring the compliance of businesses, including monitoring transaction reporting, engaging in quarterly meetings with the Major Reporters, and establishing and following up regularly on compliance action plans. We also undertook 237 examinations, many of which were focused on complex entities that provide substantial reporting to FINTRAC, levied six administrative monetary penalties and provided 10 Non-Compliance Disclosures to law enforcement.

We worked effectively throughout the year to strengthen our key partnerships in Canada and internationally. We collaborated with the Financial Consumer Agency of Canada and Scotiabank, under the umbrella of the global Finance Against Slavery and Trafficking (FAST) Survivor Inclusion Initiative, to provide new guidance to businesses, which is meant to facilitate access to banking services for the survivors of human trafficking whose financial identity may have been hijacked by their traffickers for money laundering or other criminal purposes.

Following the Russian Federation's illegal invasion of Ukraine, we collaborated with our closest allies, including the United States, Australia and the United Kingdom, to establish the Russia-Related Sanctions and Illicit Finance Financial Intelligence Units Working Group. Over the past year, members have worked within their respective authorities to surge the sharing of tactical financial intelligence and develop a common base of understanding through the dissemination of strategic-level intelligence on a variety of related issues. This work was critical in informing the development of our updated Special Bulletin on Russia-linked money laundering activities.

We also launched a first-of-its-kind international public-private partnership targeting the money laundering associated with illegal wildlife trade. While endangering the global environment and countless species at risk, this heinous activity is also a major transnational organized crime, which generates approximately $20 billion in criminal proceeds each year. By following the money and generating actionable financial intelligence for law enforcement in Canada and around the world, this international public-private partnership, named Project Anton, will be critical in identifying, pursuing and prosecuting perpetrators—and broader networks—linked to illegal wildlife trade.

As we work to meet new and evolving challenges and risks in the money laundering and terrorist financing landscape, we made important progress in modernizing our approaches, programs and technologies in 2022–23. We continued to implement numerous legislative and regulatory changes, which are helping to strengthen Canada's Anti-Money Laundering and Anti-Terrorist Financing Regime. In preparation for the introduction of a cost recovery funding model for our Compliance Program, we also took a number of key steps aimed at ensuring our compliance activities are more targeted and agile in meeting the diverse needs, expectations and capacities of all business sectors. Underpinning our broader, FINTRAC-wide modernization efforts is our comprehensive Digital Strategy, which is transforming the Centre into a leading digital organization. Investing in our data and technological capabilities, modernizing our systems, and moving to the cloud are critical to our future success as Canada's modern Financial Intelligence Unit and Anti-Money Laundering and Anti-Terrorist Financing Supervisor.

I want to recognize and thank our talented and dedicated employees for their hard work and the impressive results that are captured throughout this annual report. I am proud to work with such capable professionals who are recognized here in Canada and internationally for their knowledge, expertise and commitment to the global fight against money laundering and the financing of terrorism.

Sarah Paquet

Director and Chief Executive Officer

FINTRAC's mandate

FINTRAC is one of 13 federal departments and agencies that play a key role in Canada's Anti-Money Laundering and Anti-Terrorist Financing Regime, which is led by the Department of Finance Canada. As Canada's Financial Intelligence Unit and Anti-Money Laundering and Anti-Terrorist Financing Supervisor, the Centre helps to combat money laundering, terrorist activity financing and threats to the security of Canada.

The Centre produces actionable financial intelligence in support of investigations of Canada's law enforcement and national security agencies in relation to these threats. FINTRAC also generates valuable strategic financial intelligence, including specialized research reports and trends analysis, for regime partners and policy decision-makers, businesses and international counterparts. This strategic financial intelligence shines a light on the nature, scope and threat posed by money laundering and terrorist financing.

The Centre is able to fulfill its financial intelligence mandate by working with Canadian businesses to ensure compliance with the Proceeds of Crime (Money Laundering) and Terrorist Financing Act and associated Regulations. Compliance with the Act helps to prevent, detect and deter criminals from using Canada's economy to launder the proceeds of their crimes or to finance terrorist activities. It also ensures the Centre receives the information that it needs to produce financial intelligence for Canada's law enforcement and national security agencies.

FINTRAC's financial intelligence is in high demand internationally, as is its supervisory knowledge and expertise. The Centre is regularly asked to lead international conferences and workshops and to contribute to global research projects, training and bilateral and multilateral capacity building initiatives.

In fulfilling its core financial intelligence and compliance mandates, FINTRAC is committed to safeguarding the information that it receives and discloses to Canada's law enforcement and national security agencies. The Centre understands that the protection of privacy is critical to maintaining Canadians' confidence in FINTRAC and Canada's broader Anti-Money Laundering and Anti-Terrorist Financing Regime.

Protecting the safety of Canadians

As part of its core mandate, FINTRAC provides actionable financial intelligence to Canada's law enforcement and national security agencies to help them combat money laundering, terrorist activity financing and threats to the security of Canada. The Centre's intelligence plays a key role in helping to protect the safety of Canadians, particularly Canada's most vulnerable citizens and communities.

In 2022–23, FINTRAC generated 2,085 unique financial intelligence disclosures in support of money laundering and terrorist financing investigations across Canada and around the world.

Financial intelligence disclosures

- 2022–23 2,085

- 2021–22 2,292

- 2020–21 2,046

- 2019–20 2,057

- 2018–19 2,276

Given the complexity of connecting the flow of illicit funds often involving organized criminal groups, FINTRAC's financial intelligence often contains thousands of financial transaction reports in each disclosure. At the same time, the value of transactions in each disclosure may be in the millions or even hundreds of millions of dollars.

A financial intelligence disclosure may show links between individuals and businesses that have not been identified in an investigation, and may help investigators refine the scope of their cases or shift their sights to different targets. A disclosure can pertain to an individual or a wider criminal network, and can also be used by law enforcement to put together affidavits to obtain search warrants and production orders.

In February 2023, the Organized Crime Unit of the Winnipeg Police Service recognized FINTRAC's contribution to Project Onyx, a complex 10-month multi-jurisdictional investigation into a Manitoba-based drug network that had allegedly been importing large quantities of cocaine, methamphetamine and MDMA from Ontario and British Columbia using various methods, including commercial shipping, airline companies and highway-based drug couriers, with the drugs then distributed throughout Manitoba. Municipal, provincial and federal law enforcement working the investigation made 13 arrests and seized some 50 kilograms of cocaine, 20 kilograms of methamphetamine, $500,000 in cash, 12 vehicles and three weapons with ammunition.

FINTRAC's financial intelligence is also used to reinforce applications for the listing of terrorist entities, negotiate agreements at the time of sentencing and advance the government's knowledge of the financial dimensions of threats, including organized crime and terrorism.

More than 26% of the Centre's financial intelligence disclosures last year were provided proactively to Canada's law enforcement and national security agencies, which means the individuals or networks identified in the financial intelligence may not have been known to these agencies before FINTRAC's intelligence was received.

In 2022–23, FINTRAC's financial intelligence was used in a wide variety of money laundering investigations where the origins of the suspected criminal proceeds were linked to drug trafficking, fraud, human smuggling/trafficking, tax evasion, and other criminal offences.

Throughout 2022–23, the Centre's financial intelligence contributed to 292 major, resource intensive investigations as well as many hundreds of other individual investigations at the municipal, provincial and federal levels across the country. Canadian law enforcement agencies—particularly the Royal Canadian Mounted Police—continue to be the main recipients of FINTRAC's financial intelligence.

FINTRAC's financial intelligence disclosures are often provided to a number of agencies simultaneously when there is authorization to do so. The ability to provide multiple disclosure packages means that the Centre can help law enforcement and national security agencies connect criminal activities and operations across a number of domestic and international jurisdictions by following the money.

In November 2022, the Alberta Law Enforcement Response Teams and the Royal Canadian Mounted Police acknowledged FINTRAC's contribution to Project Collector, a three-year multi-jurisdictional investigation into a nationwide professional money laundering organization that allegedly serviced some of Canada's largest criminal groups. Project Collector revealed that the group operated pseudo-bank branches at either side of the country, which allowed organized crime groups utilizing its service to transfer funds while avoiding the detection of financial banking institutions and authorities. Seven individuals were charged with 71 criminal offences, including laundering proceeds of crime and participation in a criminal organization. Charges were also laid under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act. In addition, more than $16 million in bank accounts, real estate holdings and vehicles were placed under criminal restraint.

In June 2022, the Yukon RCMP Crime Reduction Unit acknowledged FINTRAC’s contribution to Project Monterey, an investigation into a significant drug trafficking operation, with a focus on the trafficking of opioid substances, throughout Yukon. Following the investigation, eight individuals were arrested on 29 charges related to money laundering, drug trafficking, firearms offences and participation in activities of a criminal organization. Following the arrests, the Crime Reduction Unit seized two prohibited handguns (both loaded), more than 500 grams of cocaine with a street value of $66,000, approximately 168 grams of fentanyl with a street value of $84,000, 388 Dilaudid pills, 1,043 Alprazolam pills and $148,000 in cash.

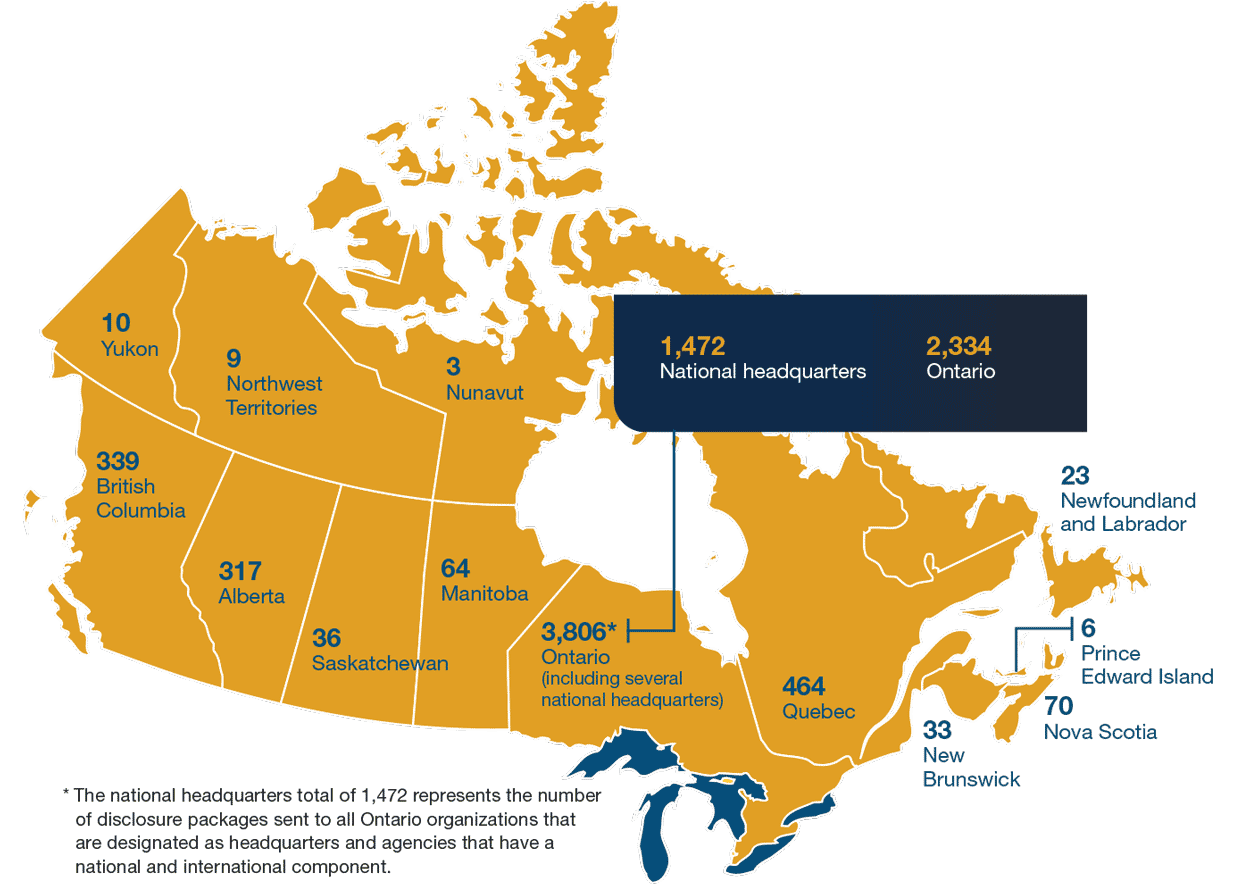

Disclosure packages by province/territory: 2022–23

View the text equivalent Disclosure packages by province/territory: 2022–23

| Ontario (including several national headquarters) National headquarters – 1,472 Ontario – 2,334 |

3,806Footnote ** |

|---|---|

Quebec |

464 |

British Columbia |

339 |

Alberta |

317 |

Nova Scotia |

70 |

Manitoba |

64 |

Saskatchewan |

36 |

New Brunswick |

33 |

Newfoundland and Labrador |

23 |

Yukon |

10 |

Northwest Territories |

9 |

Prince Edward Island |

6 |

Nunavut |

3 |

While FINTRAC is an arm's length Financial Intelligence Unit, the Centre maintains productive working relationships with Canada's law enforcement and national security agencies, among others, to ensure that its financial intelligence is relevant, timely and valuable. Throughout 2022–23, FINTRAC participated in dozens of operational meetings with municipal, provincial and federal law enforcement agencies, security commissions and other federal and provincial organizations across the country.

The Centre also met with numerous agencies and organizations across the country to strengthen collaborative efforts in combatting money laundering and terrorist financing, including the Counter-Illicit Finance Alliance of British Columbia (CIFA-BC), the Gaming Policy Enforcement Branch of British Columbia, the RCMP Integrated Market Enforcement Team in Calgary, the RCMP National Child Exploitation Coordination Centre, the Criminal Intelligence Service of Manitoba and the Criminal Intelligence Service of Ontario, the Ontario Association of Chiefs of Police, the Sûreté du Québec Asset Forfeiture Unit, Revenu Québec, and numerous Canada Border Services Agency and Canada Revenue Agency teams across Canada.

In 2022–23, the Centre presented information on the value of financial intelligence in relation to the investigation of money laundering, terrorist financing and other types of financial crime at dozens of courses and workshops throughout Canada organized by the Canadian Police College (Internet Child Exploitation Course), the RCMP (Proceeds of Crime, Child Exploitation and Cryptocurrency Investigator Courses), the Ontario Police College (Fraud and Human Trafficking Investigator Courses), Quebec's National Police College Financial Crime Course, the Canadian Association of Chiefs of Police (Human Trafficking Symposium), the Toronto Police Service (Human Trafficking Conference), the Canadian Centre to End Human Trafficking, and the National Coordinating Committee on Organized Crime.

FINTRAC always seeks feedback on its financial intelligence from disclosure recipients at the municipal, provincial and federal levels. Over the past year, the Centre received 190 disclosure feedback forms, 96% percent of which indicated that FINTRAC's financial intelligence was valuable and actionable. This is a clear and significant measure of the effectiveness of, and results achieved by, FINTRAC under the Act. Examples of the feedback that the Centre received last year can be found in Annex A.

Throughout the year, FINTRAC received 2,550 voluntary information records from Canada's law enforcement and national security agencies, as well as from members of the public. Voluntary information records provide critical information on alleged criminals and terrorists and are often the starting point for the Centre's analysis. These records are used by FINTRAC to establish connections between individuals and entities and to develop actionable financial intelligence for disclosure recipients.

The significant volume of voluntary information records received year-after-year, particularly from law enforcement at all levels, is a clear indication of the value that is placed on FINTRAC's financial intelligence.

Results through public-private partnerships

It takes a strong, equipped and committed network to defeat modern, international criminal and terrorist networks. The best example of the extensive collaboration that takes place within Canada's Anti-Money Laundering and Anti-Terrorist Financing Regime is its successful public-private partnerships.

These partnerships are aimed at more effectively combatting the laundering of proceeds stemming from human trafficking for sexual exploitation, online child sexual exploitation, romance fraud, the trafficking of illicit fentanyl, and money laundering in British Columbia and across Canada. In 2022–23, Canada launched two new public-partnerships aimed at tackling the laundering of proceeds of crime associated with international illegal wildlife trade and illicit cannabis activities.

By working with Canadian businesses and law enforcement agencies throughout Canada, FINTRAC has been effective in following the money to identify potential subjects, uncovering broader financial connections and providing intelligence to advance national project-level investigations. In total, over the past year, FINTRAC provided 569 disclosures of actionable financial intelligence to Canada's law enforcement agencies in relation to the seven public-private partnerships.

In May 2022, the RCMP acknowledged FINTRAC’s contribution to an investigation that led to charges related to over $1 million in fraudulent funds obtained through the Canada Small Business Financing Program. The investigation began following a referral from Innovation, Science and Economic Development Canada about reports of suspicious loan applications granted through the program. The scheme involved a complex network of fake and legitimate companies whereby the proceeds of crime were either transferred through or co-mingled with legitimate funds to obscure the trail. Three individuals were charged with money laundering, fraud over $5,000, providing false documents, and possession of property obtained by crime.

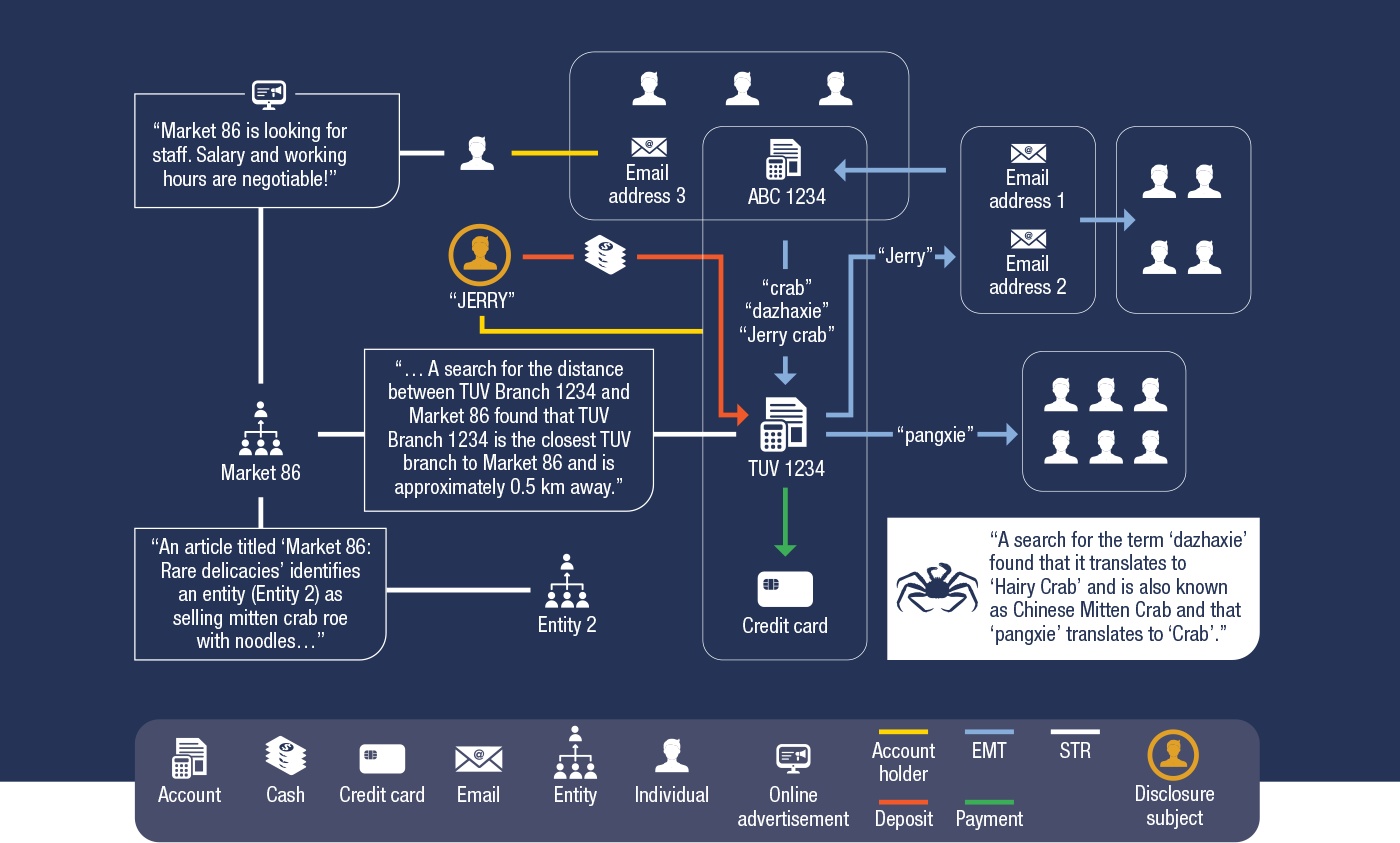

Project Anton:

Combatting illegal wildlife trade

In January 2023, FINTRAC helped to launch Project Anton, a first-of-its-kind international public-private partnership aimed at increasing awareness of illegal wildlife trade and improving the detection of the laundering of proceeds from this appalling crime. The project was named after Anton Mzimba, head of security at the Timbavati Private Nature Reserve and a Global Conservation Technical Advisor, who was murdered for his brave commitment to protecting and conserving wildlife.

Illegal wildlife trade is a major and growing threat to the global environment and biodiversity, imperilling endangered species already on the edge of survival, and threatening fragile habitats, communities and livelihoods. It also poses a serious economic, security and public health threat in Canada and around the world.

The Financial Action Task Force identified illegal wildlife trade as a major transnational organized crime, which generates billions—some have estimated approximately $20 billion (USD)—of criminal proceeds each year.

According to the Wildlife Justice Commission, illegal wildlife trade is a lucrative, low risk and high reward criminal activity, and often involves fraud schemes, tax evasion and other serious crimes that facilitate the illicit enterprise. The Commission also found that organized crime groups involved in wildlife crime are often involved in other domestic and internationally connected criminal activity such as human trafficking, drug trafficking, firearm trafficking and money laundering. This suggests that organized crime groups are continuing to grow their profits and power through wildlife crime.

Corruption is one of the most important facilitators of illegal wildlife trade. Every stage in the illegal trade chain is affected, from poaching and illegal harvesting through transportation, processing and export, to sale and the laundering of proceeds.

Project Anton is led by Scotiabank and original partners included The Royal Foundation's United for Wildlife network (founded by Prince William), FINTRAC, AUSTRAC's Fintel Alliance, the South African Anti-Money Laundering Integrated Task Force, the UK Financial Intelligence Unit–National Crime Agency, Western Union, Environment and Climate Change Canada, Fisheries and Oceans Canada, the Royal Canadian Mounted Police, the Canada Border Services Agency, and the Wildlife Justice Commission.

In support of Project Anton, FINTRAC developed a new Operational Alert, Laundering the proceeds of crime from illegal wildlife trade. Based on a strategic analysis of suspicious transaction reporting received by FINTRAC and supported by credible and compelling domestic and international research, as well as information and input from Project Anton partners, this Operational Alert includes money laundering indicators related to suspected illegal wildlife trade. These indicators are meant to assist businesses in identifying and reporting suspicious transactions to FINTRAC that may be related to illegal wildlife trade.

By following the money and generating actionable financial intelligence for law enforcement in Canada and around the world, Project Anton is assisting in identifying, pursuing and prosecuting perpetrators—and broader networks—linked to illegal wildlife trade. From the launch of the project to March 31, 2023, FINTRAC generated 22 disclosures of actionable financial intelligence in support of money laundering investigations related to illegal wildlife trade for Canada's law enforcement agencies and international partners. A sanitized case can be found in Annex B.

Project Legion:

Combatting the laundering of proceeds from illegal cannabis activities

Modelled after Canada's existing and successful public-private partnerships, Project Legion, which is led by TD Bank and supported by law enforcement agencies and FINTRAC, was launched in September 2022 to enhance awareness of the harm associated with illicit cannabis activities and to strengthen the detection of the laundering of proceeds from this crime.

Although the Cannabis Act, which provides the legal framework controlling the production, distribution, sale and possession of cannabis across Canada, came into force in 2018, 37% of respondents to the Canadian Cannabis Survey 2021 disclosed that they obtained some or all of their cannabis from illegal/unlicensed sources, including unregulated/unauthorized retailers and storefronts.

Such a flourishing and illegal cannabis market harms Canadians and Canada's financial system through the significant loss of tax revenue. The profits generated by the sale of illicit cannabis are also used by organized crime groups to fund other illegal and harmful activities in communities across the country.

Based on a review of 5,000 suspicious transaction reports received in 2020–21, FINTRAC's Operational Alert, Laundering of Proceeds from Illicit Cannabis, describes the methods used to launder the proceeds associated with this crime and provides a series of indicators related to the laundering of proceeds related to illicit cannabis activities. These indicators are meant to assist businesses in identifying and reporting suspicious transactions to the Centre in relation to this criminal activity.

Cases involving the laundering of proceeds from illegal cannabis activities are often large and complex, involving multijurisdictional networks. With its ability to provide multiple disclosure packages, FINTRAC is able to help law enforcement connect illicit cannabis activities across provincial and national boundaries by following the money. Over the past year, the Centre disclosed 169 unique suspicious transaction reports to seven different law enforcement agencies across Canada related to illegal cannabis activities. These reports were focused on 163 individuals and more than 90 accounts and totalled over $53 million in illicit sales.

In July 2022, the Hamilton-Niagara RCMP recognized FINTRAC's contribution in unravelling a sophisticated drug trafficking and money laundering scheme and the arrest of several individuals on multiple charges, including the laundering of proceeds of crime. Following a lengthy investigation, law enforcement seized a total of 29,975 cannabis plants, 7,926 pounds of dried cannabis and $1,029,020 in Canadian currency. The total value of all seized cannabis was more than $24 million.

In February 2023, the RCMP recognized FINTRAC’s contribution to the investigation and interception of a commercial truck entering Canada at the Blue Water Bridge port of entry in Point Edward, Ontario. Upon inspection of the trailer, Canada Border Services Agency officers discovered 84 bricks of suspected cocaine, weighing approximately 84 kilograms. The RCMP took custody of the subject and charged him with importation and possession of cocaine for the purpose of trafficking.

Canada's ongoing public-private partnerships

Project Protect:

Combatting human trafficking for sexual exploitation

- Key contribution to the Government of Canada's National Strategy to Combat Human Trafficking

- Launched in 2016 as Canada's first public-private partnership

- Targets the money laundering associated with human trafficking for sexual exploitation

- Inspired by Timea Nagy, a leading advocate for victims, and led by BMO, with the support of other banks, law enforcement and FINTRAC

- Published an Operational Alert in 2016, The laundering of illicit proceeds from human trafficking for sexual exploitation, to increase awareness of money laundering in relation to human trafficking in the sex trade

- FINTRAC's 2021 Operational Alert, Updated Indicators: Laundering of Proceeds from Human Trafficking for Sexual Exploitation, provided 58 additional indicators to assist businesses in better identifying and reporting suspicious transactions associated with human trafficking for sexual exploitation

- Generated 315 financial intelligence disclosures, 72% of which were proactive

- Supported 21 project-level investigations of 20 different municipal, provincial and federal police forces across Canada

- In February 2023, members of Ontario's Human Trafficking Intelligence-led Joint Forces Strategy (IJFS) from the Ontario Provincial Police, Toronto Police Service, Greater Sudbury Police Service and Treaty Three Police Service acknowledged FINTRAC's assistance to its human trafficking investigations. Since the IJFS was created in December 2021, its member police services have conducted 65 investigations, assisted 61 victims, laid 72 human trafficking charges and 167 other charges against 28 people. The victims ranged from 12 to 47 years old.

Project Shadow:

Targeting online child sexual exploitation

- Co-led by Scotiabank and the Canadian Centre for Child Protection, and supported by Canadian law enforcement agencies and FINTRAC

- Targets the laundered funds associated with online child sexual exploitation, a heinous crime often directed at vulnerable children

- Published an Operational Alert in 2020, Laundering of Proceeds from Online Child Sexual Exploitation

- Generated 60 financial intelligence disclosures, 75% of which were proactive

- Financial intelligence disclosures included 174 unique suspicious transaction reports on 274 subjects of interest from all 10 provinces and 2 Canadian territories

Project Guardian:

Countering the trafficking of fentanyl

- Launched in 2018 to combat money laundering associated with the trafficking of illicit fentanyl

- Key contribution to the Federal Action on Opioids

- FINTRAC's Operational Alert, Laundering of the proceeds of fentanyl trafficking, helps businesses identify the laundering of proceeds of crime related to the trafficking of fentanyl

- Disclosed 127 unique suspicious transaction reports on 78 different subjects

- Supported 79 law enforcement investigations, including 52 proactively

- In July 2022, the Alberta Law Enforcement Response Teams acknowledged FINTRAC's contribution to an investigation that led to the arrest of two suspects and seizure of about $135,000 worth of drugs, including more than 1.3 kilograms of suspected fentanyl, 1,110 illicit prescription pills, 1 gram of cocaine, suspected GHB and $15,400 in cash

Project Athena:

Combatting money laundering in British Columbia and across Canada

- Launched in 2019 to improve the collective understanding of the money laundering threat, strengthen financial systems and controls, and disrupt money laundering activity in British Columbia and across Canada

- FINTRAC's Operational Alert, Laundering the proceeds of crime through a casino-related underground banking scheme, assists businesses in identifying suspicious transactions that may be related to professional money launderers and money laundering organizations

- Generated 45 disclosures of actionable financial intelligence involving 61 subjects

- Disclosed 71 unique suspicious transaction reports to 17 different law enforcement agencies across three provinces

- Project Athena team continued to strengthen its relationships in British Columbia, notably with the Joint Illegal Gaming Investigation Team, and expanded the project into Alberta, Quebec and Ontario

- FINTRAC is a partner in the Counter-Illicit Finance Alliance of British Columbia, which is focused on enhanced collaboration and strategic information exchange between the public and private sectors with the goal of protecting the economic integrity of British Columbia

Project Chameleon:

Tackling romance fraud

- Launched in 2017 to counter the laundering of proceeds stemming from romance fraud

- Romance fraud involves perpetrators expressing false romantic intentions toward victims to gain and then take advantage of their trust and affection in order to access their cash, bank accounts and credit cards

- Project Chameleon has mobilized businesses, FINTRAC and law enforcement with the goal of identifying the perpetrators and helping to protect victims and their money

- In consultation with the Canadian Anti-Fraud Centre, FINTRAC published an Operational Alert, Laundering of the proceeds of romance fraud aimed at assisting Canadian businesses in identifying this illicit activity and reporting suspicious transactions

- Provided 50 financial intelligence disclosures in 2022–23 to law enforcement across Canada that included more than 90 unique suspicious transaction reports

Enhancing awareness of money laundering and terrorist financing

FINTRAC produces valuable strategic intelligence in the fight against money laundering and terrorist financing. Through the use of research and analytical techniques, the Centre is able to identify emerging characteristics, trends and tactics used by criminals to launder money or fund terrorist activities. The goal of FINTRAC's strategic intelligence is to inform Canada's security and intelligence community, regime partners and policy decision-makers, businesses, Canadians, and international counterparts about the nature and extent of money laundering and terrorist financing in Canada and throughout the world.

Over the past year, FINTRAC produced 21 strategic financial intelligence assessments and reports on a range of specific money laundering and terrorist financing trends, typologies and mechanisms in order to improve the detection, prevention and deterrence of these activities. These assessments and reports covered key priority areas, including professional money laundering, terrorist activity financing, money laundering undertaken by domestic and international organized crime, laundering the proceeds of sexual exploitation, and issues related to economic and institutional integrity.

While many of these assessments and reports are classified, FINTRAC is closely monitoring a number of key themes and risks that can be shared publicly. Efforts to avoid traditional financial channels were the dominant emerging theme of 2022–23, as money launderers and those financing terrorism sought to avoid detection or evade measures meant to restrict the flow of illicit and threat financing. While the traditional financial sector—albeit cloaked in complex methods of misdirection—remains the preferred channel for the flows of transnational proceeds of crime, such as Russia-linked professional money launderers, there was continued broad-based adoption of small-scale terrorist financing and money laundering methods that focused on alternative methods.

Professional money laundering techniques observed in Russia-linked illicit finance

The most significant development in the context of illicit financial flows has been the introduction of international sanctions against Russia following its illegal invasion of Ukraine. This has prompted increased scrutiny of Russia-linked financial flows.

In March 2022, FINTRAC produced a Special Bulletin on Russia-linked Money Laundering Related to Sanctions Evasion to increase the awareness of Canadian businesses subject to the Proceeds of Crime (Money Laundering) and Terrorist Financing Act about the laundering of the proceeds of crime that may also be connected to the evasion of sanctions that have been imposed under the Special Economic Measures Act.

Following an analysis of the transaction reporting that FINTRAC received from businesses throughout the year, the Centre updated the Special Bulletin with additional information related to Russia-linked money laundering activities. This information showed that Russian entities and individuals moving criminal proceeds rely on established professional money laundering networks and techniques to transfer funds from Russia to other jurisdictions. Such methods include the use of shell and front companies, offshore financial centres and secrecy jurisdictions known to cater to money laundering networks.

Underground banking through unregistered MSBs

The use of unregistered money services businesses continues to present challenges for those seeking to detect money laundering and terrorist financing through traditional financial channels. In May 2022, FINTRAC published a Sectoral and Geographic Advisory, Underground Banking through Unregistered Money Services Businesses, accompanied by a video, to assist businesses and Canadians in better protecting themselves against illicit activities associated with underground banking, and to facilitate the reporting of suspicions of money laundering or terrorist financing to FINTRAC. The advisory describes key attributes of underground banking in Canada, particularly as it is carried out by unregistered money services businesses in Metro Vancouver, the Greater Toronto Area, and, to a lesser extent, in the Calgary-Edmonton Corridor.

Since the publication of this Sectoral and Geographic Advisory, FINTRAC has seen an increase in reporting on money laundering associated with underground banking, as well as the identification of individuals and entities suspected to be operating unregistered money services businesses. Suspicious transactions reported to FINTRAC have highlighted the significant role of third party intermediaries, such as professional money launderers and money mules, in facilitating underground banking and the laundering of criminal proceeds. Underground banking through unregistered money services businesses continues to be leveraged by international actors seeking to evade sanctions or engage in other types of illicit activity, such as terrorist or threat financing.

Continued adoption of virtual currency methods in the face of the "crypto-winter"

Building on funding received in Budget 2021 and Budget 2022, FINTRAC's strategic intelligence program deepened its expertise and understanding of risks and vulnerabilities associated with virtual currencies. In 2022–23, FINTRAC developed, and shared with partners, research into areas of emerging risk in this space and generated targeted strategic intelligence products looking at the role that cryptocurrency plays in money laundering and terrorist financing.

Despite the decline in prices for virtual assets, FINTRAC expects to see further long-term growth in the adoption of cryptocurrency by illicit and threat actors seeking to raise, move and hide funds outside the traditional banking system.

Laundering the proceeds of fraud and ransomware attacks continues to be the most prevalent form of money laundering involving virtual currencies. Despite massive growth in the number of identified cryptocurrency-related fraud schemes, the ways in which criminals defraud their victims and launder the proceeds of fraud are likely to remain consistent. Similarly, ransomware will remain a threat to Canadians and their livelihoods in the years to come due in part to the growing availability of malware linked to the Ransomware-as-a-Service model, which makes advanced ransomware available to less sophisticated actors via darkweb marketplaces.

FINTRAC has observed an overwhelming reliance on mixing services and high-risk exchanges to launder cryptocurrency and to convert ransoms back into fiat currency. Centralized exchanges are also frequently used to launder and cash-out smaller amounts. Decentralized Finance (DeFi) services may also present risks to Canada's Anti-Money Laundering and Anti-Terrorist Financing Regime and will necessitate greater due diligence by those facilitating the use and adoption of DeFi services.

While the majority of illicit transactions through cryptocurrency relate to the laundering of the proceeds of crime—which are themselves a small proportion of overall virtual transactions undertaken—FINTRAC has observed the increased use of virtual currencies by terrorist groups globally to fund their activities. This is particularly true of threat actors associated with ideologically motivated violent extremism due to a mistrust of regulated and centralized financial systems. In addition to organized threat actors and lone actors, recent years have seen an increase in loose connections with broad movements that transcend borders as well as a continuation of cross-border funding networks and online fundraising.

In June 2022, the Saskatchewan RCMP Federal Serious and Organized Crime Unit recognized FINTRAC’s contribution to an investigation into a sophisticated crime group that was allegedly distributing large quantities of drugs to numerous communities across Alberta and Saskatchewan. Following the lengthy investigation, seven individuals were charged with 70 criminal offences, including conspiracy to traffic in a controlled substance, trafficking in a controlled substance and property obtained by crime. Police also seized 2.97 kilograms of methamphetamine, about 600 grams of cocaine, more than 9,000 grams of Meclonazepam (approximately 30,000 fake Xanax pills) and $123,652 in Canadian currency.

Use of crowdfunding as a component in terrorist financing

International awareness of crowdfunding techniques to finance terrorist activity has increased in recent years. Crowdfunding activities leverage social media and sometimes dedicated crowdfunding platforms—websites or applications that are used to raise funds or virtual currency through donations—to collect funds from a wide audience. Small donations, subscriptions or payments provide an important financing base for a variety of activities undertaken by individual threat actors and groups.

The extension of Canada's Anti-Money Laundering and Anti-Terrorist Financing Regime to capture crowdfunding platform services and certain payment service providers within its money services businesses framework is expected to help in the detection, prevention and deterrence of money laundering and terrorist financing. FINTRAC expects terrorist entities to continue to shift towards alternative fiat crowdfunding platforms online as a result of increased vigilance by mainstream platforms. Other groups are likely to increase the sophistication of their crowdfunding efforts by leveraging new technologies, such as cryptocurrency.

In December 2022, FINTRAC published a broader Operational Alert on Terrorist Activity Financing to assist businesses subject to the Proceeds of Crime (Money Laundering) and Terrorist Financing Act in identifying and reporting suspicious transactions and terrorist property to FINTRAC. Following a strategic analysis of the Centre's financial intelligence disclosures from 2019 to 2022, FINTRAC determined that the terrorist activity financing was focused on domestic terrorism, the financing of international terrorist groups and Canadian extremist travellers.

The majority of FINTRAC's financial intelligence disclosures associated with domestic terrorism, where the target of terrorism was in Canada, were related to ideologically motivated violent extremism and involved lone actors, cross-border networks and organized groups, including entities listed under the Criminal Code. The Centre's analysis revealed that ideologically motivated violent extremism financing activity included actors located and operating in Canada.

FINTRAC also found that transactions relating to the financing of international terrorist groups consisted primarily of outgoing funds transfers to another country, particularly to jurisdictions of concern for terrorist activity financing such as Iraq, Lebanon, Pakistan, Syria, Turkey, United Arab Emirates and Yemen. Within its disclosures, the Centre determined that the most frequently identified international terrorist entities were Daesh and Hizballah.

The Operational Alert noted that FINTRAC continued to receive suspicious transaction reports related to the threat of Canadian extremist travellers, particularly in relation to financial transactions associated with the five phases identified in FINTRAC's 2018 Terrorist Financing Assessment: pre-departure, en route, in theatre, returning, and interrupted travel.

In January 2023, the RCMP Federal Policing Transnational Serious and Organized Crime team in Toronto acknowledged FINTRAC’s contribution to an extensive investigation into a large-scale drug importation network that resulted in four individuals being charged with eight offences, including importing, trafficking, and conspiracy to import cocaine and possessing property obtained by crime. Following the investigation, police seized 88 units of Ether cryptocurrency, a 2022 Mercedes Benz G-wagon, over $2 million in jewelry, watches and other luxury items, and $800,000 in Canadian currency.

Safeguarding Canada's financial system

As part of its core mandate, FINTRAC administers a comprehensive, risk-based compliance program to assist and ensure that thousands of businesses fulfill their obligations under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act and associated Regulations.

These obligations allow for certain economic activities to be more transparent, which helps deter criminals and terrorists from using Canada's financial system to launder the proceeds of their crimes or finance terrorist activities.

Compliance with the legislation also ensures that FINTRAC receives the information that it needs to generate actionable financial intelligence for Canada's law enforcement and national security agencies. Financial transaction reporting statistics from 2022–23 can be found in Annex C.

As FINTRAC prepares for the introduction of a cost recovery funding model for its Compliance Program, which begins on April 1, 2024, the Centre has launched a multi-year modernization initiative called R.I.S.E. (Respond, Innovate, Simplify, Evolve) aimed at ensuring that its compliance activities are more targeted and agile in meeting the diverse needs and expectations of all business sectors. FINTRAC wants to make it easier for businesses to fulfil their legal obligations by providing meaningful support, refined processes, service and tools, among other efficiencies. The Centre is also focused on equipping its people with greater automation, digital tools and solutions to keep pace with the innovative technologies used by businesses.

FINTRAC took a number of concrete steps in 2022–23 as part of its R.I.S.E. initiative, including establishing a modernization team and conducting comprehensive research and engagement with businesses, associations and relevant stakeholders to seek their views on how to improve the reach, accessibility, responsiveness and impact of FINTRAC's Compliance Program. This research has supported foundational analysis, planning and development of the modernization agenda with key activities and service-oriented opportunities going forward. As part of the R.I.S.E. initiative, FINTRAC has also implemented a number of technological building blocks to support modernization on a broad scale, including the creation of a new cloud-based controlled-access testing portal in order to streamline the adoption of system-to-system reporting.

In addition to advancing the broader R.I.S.E. initiative, FINTRAC's Compliance Program remained focused on its three pillars: assistance, assessment and enforcement.

Assistance to businesses

FINTRAC is committed to working with businesses across the country to assist them in understanding and complying with their obligations under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act and associated Regulations.

Comprehensive guidance

In addition to publishing comprehensive and sector-specific guidance for businesses subject to the Act, FINTRAC provides timely and targeted guidance in relation to legislative and regulatory changes and other compliance-related issues on an ongoing basis.

In 2022–23, the Centre worked closely with the Financial Consumer Agency of Canada and Canada's banks, under the umbrella of the global Finance Against Slavery and Trafficking (FAST) Survivor Inclusion Initiative, to provide guidance to financial institutions in relation to identifying vulnerable clients, including survivors of human trafficking for sexual exploitation, who may not have proper identification documentation or information to open a retail deposit account. The financial identity and/or banking products of survivors of human trafficking for sexual exploitation are often hijacked by their traffickers for money laundering or other criminal purposes. This updated guidance—the first-of-its-kind in the world—will help to prevent the re-victimization of the survivors of this appalling illicit activity by facilitating their access to basic banking services and products that are so fundamental to our daily lives.

Over the past year, FINTRAC also developed and launched a new video series to help businesses better understand how to meet their obligation to verify the identity of their clients. This obligation removes the anonymity from financial transactions and is one of the most important measures in place to protect Canada's financial system from money launderers and terrorist financiers. The videos posted in 2022–23 (and more to come in 2023–24) capture, in a simple and succinct way, the different methods that businesses can use to verify the identity of a person or entity conducting a financial transaction. The videos are meant to increase the awareness and understanding of businesses of their obligation and support their anti-money laundering and anti-terrorist financing training needs. They have been viewed thousands of times to date and have been very well received by businesses and stakeholders.

In April 2022, crowdfunding platforms and certain payment service providers became subject to legal obligations under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act as money services businesses. These obligations include registering with FINTRAC, developing and maintaining a compliance program, identifying clients, keeping certain records, including records related to transactions and client identification, and reporting certain financial transactions, including international electronic funds transfers and suspicious transactions. The Centre published comprehensive new guidance tailored to the businesses affected by this change to assist them in understanding and complying with the new obligations.

In March 2023, York Regional Police acknowledged FINTRAC’s contribution to Project Norte, a multi-jurisdictional investigation that exposed a human trafficking ring in the Greater Toronto Area that was exploiting migrants lured from Mexico to Canada with the promise of a better life. Search warrants were executed at five properties in Vaughan, East Gwillimbury, Toronto and Mississauga. As a result, 64 exploited workers were rescued, five people were arrested and charged, and two outstanding suspects had warrants issued for their arrest.

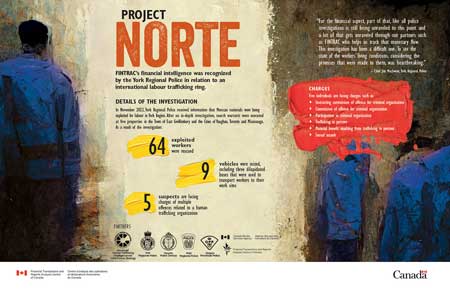

View text equivalent for the Project Norte poster

This poster depicts the contribution that FINTRAC's financial intelligence made in Project Norte.

FINTRAC's financial intelligence was recognized by the York Regional Police in relation to an international labour trafficking ring.

In November 2022, York Regional Police received information that Mexican nationals were being exploited for labour in the York region. After an in-depth investigation, search warrants were executed at five properties in the Town of East Gwillimbury and the cities of Vaughan, Toronto and Mississauga. As a result of the investigation:

- 64 exploited workers were rescued

- 5 suspects are facing charges of multiple offences related to a human trafficking organization

- 9 vehicles were seized, including three dilapidated buses that were used to transport workers to their work sites

Five individuals are facing charges such as:

- Instructing commission of offence for criminal organization

- Commission of offence for criminal organization

- Participation in criminal organization

- Trafficking in persons

- Material benefit resulting from trafficking in persons

- Sexual assault

Partners: York Regional Police, Canada Border Services Agency, Ontario Provincial Police, Provincial Human Trafficking Intelligence-led Joint Forces Strategy, Toronto Police Service, Peel Regional Police, and Financial Transactions and Reports Analysis Centre of Canada

Quote from York Regional Police Chief Jim MacSween: “For the financial aspect, part of that, like all police investigations is still being unraveled to this point and a lot of that gets unraveled through our partners such as FINTRAC who helps us track that monetary flow. This investigation has been a difficult one. To see the state of the workers' living conditions, considering the promises that were made to them, was heartbreaking.”

FINTRAC also engaged extensively with crowdfunding platforms, payment service providers and key stakeholders throughout the year to ensure the entities were aware of the new requirements. This included hosting numerous information sessions for implicated businesses, lawyers, consultants and financial entities; presenting information on FINTRAC and the requirements to Fintechs Canada, an association of Canadian financial technology companies primarily engaged in the payments space; and meeting with the National Payments Institute to clarify the Centre's position with respect to payroll services providers. FINTRAC also spoke regularly of the new requirements in relation to crowdfunding platforms and certain payment service providers at conferences across the country, including at the Association of Certified Anti-Money Laundering Specialists Conference in Toronto.

Outreach and engagement

In total in 2022–23, FINTRAC undertook 193 outreach and engagement activities with businesses, industry associations, provincial regulators, federal departments and regulators, stakeholders and international partners through virtual and onsite meetings, presentations, conferences, training, and other exchanges of information. The Centre also conducted consultations on a number of issues, including new and revised guidance, reporting forms and the implementation of regulatory amendments.

Through the FINTRAC Reporting Working Group and Guidance and Policy Interpretation Working Group, which is a sub-committee of the Advisory Committee on Money Laundering and Terrorist Financing, and sector-specific consultations, FINTRAC continued to enhance understanding of the regulatory requirements that came into effect in June 2021. In addition, the Centre consulted with the Guidance and Policy Interpretation Working Group and published draft guidance in relation to the reporting of suspicious transactions and large cash transactions in the new forms.

In order to strengthen collaboration, cooperation and information sharing in the fight against money laundering and terrorist financing, FINTRAC signed a new compliance Memoranda of Understanding with the Bank of Canada. This agreement will enable the sharing of information on payment service providers and money services businesses in the context of the Bank of Canada's new supervisory functions under the Retail Payment Activities Act (RPAA), set to come into force in 2024. The agreement allows the exchange of both mandatory information outlined in the RPAA as well as other key supervisory information to assist both regulators advance their respective compliance mandates.

Maintaining regular and constructive dialogue with Canada's financial institutions is critical to the success of Canada's Anti-Money Laundering and Anti-Terrorist Financing Regime given these organizations provide approximately 90% of the reporting that FINTRAC receives every year. Over the past year, the Centre undertook 81 proactive engagement activities with Canada's largest financial institutions and with small- and medium-sized banks on examinations, follow-up examinations and reports monitoring. This includes meeting with each large bank on a quarterly basis to monitor the ongoing state of their anti-money laundering and anti-terrorist financing program and what they are doing to identify and address risks to the financial system.

In February 2023, FINTRAC hosted a Banking Forum for Chief Anti-Money Laundering Officers, compliance officers and their delegates from across Canada's banking sector. In total, more than 100 attendees gathered in person and over 250 people joined virtually from all Canadian banks, five other federal agencies, the Canadian Bankers Association and other stakeholder organizations. The theme for the forum was "Future Forward: Risk-Based Frameworks for a Digital Age" and included discussions on FINTRAC's Compliance Modernization, the anticipated Parliamentary Review of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act, FINTRAC's modern approach to assessing and enforcing compliance, and the promise of artificial intelligence in RegTech.

In April 2022, the Ottawa Police Service Human Trafficking Unit acknowledged FINTRAC’s contribution to Project Exodus, an investigation that led to more than 40 charges against four individuals, including in relation to sexual assault, trafficking in persons under 18 by recruiting, trafficking in persons under 18 by exercising control, financial/material benefit from trafficking in person over 18, and withholding/destroying travel or identity document/trafficking in person over 18. The investigation began in June 2021 and involved four female victims. Three of the victims were under the age of 18 at the time of the offences that occurred between 2013 and 2020. Investigators continued to search for additional victims in this case.

Over the past year, FINTRAC also continued to strengthen its engagement in the real estate sector across the country. Beginning in October 2022, the Centre established monthly touch points with the Canadian Real Estate Association to discuss regulatory expectations, high-level examination trends and explore new ways of working together to strengthen anti-money laundering and anti-terrorist financing compliance in the sector. FINTRAC has also collaborated, on a regular basis, with the British Columbia Real Estate Association, participating in webinars in relation to compliance obligations and addressing questions from the sector on administrative monetary penalties in British Columbia. In addition, FINTRAC is assisting the association in the creation of a training module in relation to identifying suspicious transactions and reporting them to the Centre.

In early 2022, FINTRAC hosted its first National AML/ATF Real Estate Virtual Forum. This event was made available on demand from March 18 to April 30, 2022, and consisted of 22 sessions, recorded in English, French and in a bilingual format. Designed for the real estate sector, the forum offered comprehensive presentations and discussions on the legislative obligations, including the importance of suspicious transaction reporting, and the critical role that Canada's Anti-Money Laundering and Anti-Terrorist Financing Regime plays in protecting Canadians and Canada's economy. Various real estate regulators, associations and law enforcement stakeholders took part in a panel discussion, provided additional resources, and publicized the forum to their members. Approximately 3,000 registrants from across Canada participated in the forum.

As well, over the past year, FINTRAC also provided a number of presentations and participated in numerous symposia and webinars focused on enhancing understanding and compliance with the obligations under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act and Regulations, including in association with the Canadian Life and Health Insurance Association, the Canadian Jewelers Association and the Canadian Credit Union Association.

Policy interpretations

Policy interpretations provided

- 2022–23 302

- 2021–22 365

- 2020–21 445

In 2022–23, FINTRAC provided 302 policy interpretations to clarify its approach to the application of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act. Common interpretations were related to regulatory changes, verifying identity, reporting international electronic funds transfers, and determining whether a business was considered a reporting entity under the Act. FINTRAC's policy interpretations, many of which involve complex business models, are generally posted on its website without identifying information, to assist other businesses that may have similar questions.

Responses to enquiries

Number of queries answered

- 2022–23 10,978

- 2021–22 7,664

- 2020–21 6,778

Throughout 2022–23, FINTRAC responded to 10,978 enquiries from businesses in every reporting sector on a broad range of issues, including reporting obligations, access to reporting systems, the registration of money services businesses, and the requirements associated with the regulatory amendments that came into force in June 2021.

Money services business registry

Businesses that exchange foreign currencies, transfer money, cash/sell money orders or traveller's cheques, or deal in virtual currency must register with FINTRAC before offering these services to the public. Moreover, they must renew their registration every two years. A registration with FINTRAC does not indicate an endorsement or licensing of the business. It only means that the business has fulfilled its legal requirement under the Act to register with FINTRAC.

Individuals convicted of certain offences under, among other statutes, the Proceeds of Crime (Money Laundering) and Terrorist Financing Act, the Controlled Drugs and Substances Act or the Criminal Code are ineligible to register a money services business in Canada. Should such a determination be made, the registration is either denied or revoked. Money services businesses are also required to respond to demands for information from FINTRAC or their registrations are revoked. In total, there were 81 revocations in 2022–23. In order to enhance transparency and assist other business sectors with their risk assessments, FINTRAC publishes, on a quarterly basis, the names of money services businesses whose registration has been revoked.

The Centre also undertakes a validation initiative every year to confirm the existence of specific money services businesses and determine where entities may potentially be operating without being registered (i.e., illegally) with the Centre. In 2022–23, FINTRAC conducted 188 validations on money services businesses in Canada that were suspected of being unregistered. This resulted in 20 new entities registering with FINTRAC.

In total last year, 1,201 money services businesses registered or were renewed with FINTRAC. In addition, 219 businesses ceased their registrations and 296 registrations expired. As of March 31, 2023, 2,489 money services businesses were registered with the Centre.

Assessment

In addition to assisting businesses in understanding their obligations, FINTRAC has a number of different assessment tools in place to verify the compliance of more than 24,000 businesses across the country. In recent years, the Centre has shifted from an audit to an assessment approach to ensuring compliance, where the emphasis is on a more holistic view of the overall effectiveness of a business's compliance program, including the impact of non-compliance on the objectives of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act and FINTRAC's ability to carry out its mandate.

Data quality of financial transaction reports

FINTRAC monitors the quality, timeliness and volume of the financial transaction reporting that it receives from businesses across the country. The Centre has invested heavily in validating and monitoring reporting data, including improving its business processes to increase the effectiveness of its monitoring. In 2022–23, FINTRAC received a total of 36,286,939 financial transaction reports from businesses. The Centre rejected 73,878 reports for not meeting quality requirements. It accepted 456,068 financial transaction reports for which it subsequently issued a warning to businesses about the quality of those reports.

When issues relating to reporting data quality, timing or volume are identified, FINTRAC addresses them through engagement, an examination or another compliance activity. Through this type of data monitoring, the Centre is also able to identify over-reporting and follow up with businesses to remove or delete from their database those reports that should not have been received.

In October 2022, the RCMP Federal Policing Integrated Money Laundering Investigative Team in Calgary, Alberta, recognized FINTRAC’s contribution to a comprehensive investigation of a mortgage fraud scheme that led to charges against an individual for fraudulently purchasing property and money laundering. It was alleged that the individual defrauded millions of dollars from multiple financial institutions in the Calgary area between 2015 and 2020.

Compliance examinations

Examinations are one of FINTRAC's primary instrument for assessing the compliance of businesses subject to the Act. The Centre uses a risk-based approach to select the businesses that will be examined every year, focusing a significant portion of its examination resources on businesses that report large numbers of transactions or are at a higher risk of being deficient or exploited by money launderers or terrorist financiers. Consistent with its transition from an audit to an assessment approach over the past few years, FINTRAC has undertaken more complex, lengthy and in-depth examinations of larger businesses in higher risk sectors in order to determine how effectively they are fulfilling their compliance obligations.

FINTRAC has also modernized and enhanced its engagement with businesses and its risk-based approach to ensuring compliance with the Act and Regulations. Recognizing that different business sectors have varying levels of knowledge of their obligations and differing needs, examinations serve to increase awareness and understanding of the requirements under the Act and the role businesses play in combatting money laundering and terrorist financing; improve compliance with the Act; strengthen the identification and monitoring of high-risk clients; and enhance reporting to FINTRAC.

Of FINTRAC's 237 examinations over the past year, the largest number of examinations was focused on the money services business sector (88). This was followed by the real estate sector (71) and securities dealers (38).

In 2022–23, 95% of businesses assessed by FINTRAC did not require enforcement action. This means that these assessments resulted in no further activity or in a follow-up activity instead of enforcement (e.g., data integrity monitoring, a follow-up assessment, an action plan, etc.).

In January 2023, the RCMP Federal Policing Transnational Serious and Organized Crime team in Kitchener, Ontario recognized FINTRAC’s contribution to an investigation that led to the unraveling of a sophisticated international drug importation scheme and the arrest of three individuals on multiple charges. After tracking a marine shipping container of interest from Central America to Saint John, New Brunswick, Canada Border Services Agency officers seized more than 1.5 tonnes of cocaine concealed within industrial machinery. The total value of the seized cocaine was approximately $198 million.

FINTRAC regularly reminds businesses of its Voluntary Self-declaration of Non-compliance, a mechanism for informing the Centre when businesses face instances of non-compliance. Promoting open dialogue and transparency without the threat of a penalty allows the Centre to work collaboratively with businesses in addressing non-compliance that they have identified. In particular, this mechanism helps to ensure that FINTRAC receives reporting that it otherwise might not have, information that is critical to the production of actionable financial intelligence for Canada's law enforcement and national security agencies.

In 2022–23, FINTRAC received 281 Voluntary Self-declaration of Non-compliance notices. Financial institutions submitted the majority of these declarations in relation to reports that had not been provided. The Centre collaborated with these financial institutions to ensure that the transactions were submitted accurately to FINTRAC, and provided guidance when it was required.

Follow-up activities

Follow-up activities can take a number of forms, including a recommendation to examine a particular business in the near future or requiring an entity to provide regular updates on its progress in addressing the deficiencies that have been identified by the Centre.

Follow-up examinations are an assessment tool that FINTRAC leverages, when appropriate, to determine if a business has addressed previous instances of non-compliance. In 2022–23, the Centre conducted 40 follow-up examinations. Of these, no further activity was required in 18 cases as the businesses demonstrated a positive change in their compliance behaviour. The remaining 22 examinations resulted in an enforcement action or a recommendation for additional follow-up activity.

FINTRAC has established a process for monitoring financial entities' compliance with their action plan commitments following an examination. The process constitutes ongoing feedback to entities on the actions they take to strengthen their compliance program and address exam findings. An action item is considered closed once the financial entity can demonstrate that it has taken all appropriate corrective measures. The Centre's ongoing engagement with financial entities following an examination reinforces positive compliance behaviours and promotes higher rates of compliance during follow-up activities.

Enforcement

FINTRAC is committed to working with businesses to assist them in understanding and complying with their obligations. However, the Centre is also prepared to take firm action when it is required to ensure that businesses take their responsibilities seriously. This includes imposing administrative monetary penalties when warranted and providing Non-Compliance Disclosures to law enforcement. Businesses must never lose sight of the fact that Canada's Anti-Money Laundering and Anti-Terrorist Financing Regime is about protecting Canadians and the integrity of Canada's financial system.

In June 2022, the Alberta Law Enforcement Response Teams acknowledged FINTRAC’s contribution to Project Deception, an interprovincial joint forces investigation focused on disrupting the drug supply line and uprooting Edmonton and Kelowna-based suppliers. Following a search of multiple homes, a large quantity of cocaine, fentanyl and methamphetamine was seized with an estimate street value of $571,000. Police also seized two handguns with ammunition, $147,872 in restrained assets, including jewelry, and $101,888 in cash.

Administrative monetary penalties

In 2008, FINTRAC received the legislative authority to issue administrative monetary penalties to businesses that are in non-compliance with the Proceeds of Crime (Money Laundering) and Terrorist Financing Act. Under the legislation, penalties are intended to be non-punitive and are focused on changing the non-compliant behaviour of businesses. The administrative monetary penalties program supports FINTRAC's mandate by providing a measured and proportionate response to particular instances of non-compliance.