Administrative monetary penalties policy

The purpose of FINTRAC's Administrative monetary penalties (AMPs) program is to encourage future compliance with the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (the Act) and its regulations, and to promote a change in behaviour. The AMP program supports FINTRAC's mandate by providing a measured and proportionate response to particular instances of non-compliance. FINTRAC is committed to working with reporting entities (REs) to help them achieve compliance. AMPs are not issued automatically in response to non-compliance, as typically other compliance actions are taken to change behaviour before a penalty is considered.

Purpose

The purpose of this policy is to provide a framework for the determination of an AMP; and to summarize the principles and guidelines that are used by FINTRAC to issue an AMP.

Our operating principles and framework

The purpose of the AMP program is to support FINTRAC’s efforts to ensure compliance with the Act and its regulations by providing a measured response to non-compliance issues. The program’s guiding principles are:

Objectivity: FINTRAC officers will conduct themselves professionally during an assessment and in their communications with an RE. FINTRAC officers will make objective assessments based on the facts and circumstances of each case, ensuring fair and reasonable decisions.

Reasonableness: FINTRAC officers will exercise professional judgement when assessing an RE's compliance with the Act and its regulations. This involves considering the circumstances and all relevant factors prior to considering an AMP.

Transparency: FINTRAC officers will make sure that the expectations about compliance are communicated in a clear manner throughout the assessment process. REs will be provided with FINTRAC's findings and observations, and will be given the opportunity to ask questions and respond to the non-compliance identified before the findings are finalized.

Fairness: An RE has the right to understand the case being made for an AMP, and will have a fair opportunity to respond.

Consistency: FINTRAC officers follow established policies and procedures to make sure that similar REs, with the same types and extent of non-compliance, can expect to be treated in a similar manner.

Documentation: FINTRAC officers will rely on facts and document those facts and any other information to support their analysis and findings.

Background and application

FINTRAC works with businesses and law enforcement to combat money laundering (ML) and terrorist activity financing (TF). By effectively identifying clients and keeping records, REs help deter criminal activity and are able to provide law enforcement with evidence for the investigation and prosecution of ML/TF offenses. By reporting the required financial transactions to FINTRAC, REs are supplying it with the information that it needs to carry out its mandate, support law enforcement partners, and contribute to the protection of the integrity of Canada's financial system and the safety of Canadians.

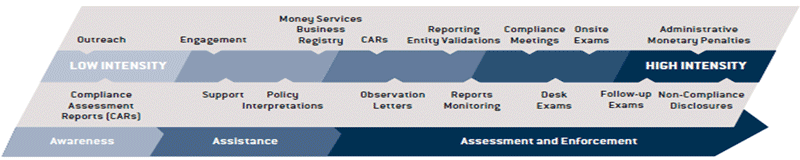

FINTRAC's compliance framework recognizes that the success of Canada's Anti-Money Laundering / Anti-Terrorist Financing (AML/ATF) regime depends on the concrete application of the regulatory measures designed to detect, prevent and deter ML/TF activity. Our own compliance effort aims to bring awareness and understanding of the requirements under the Act and its regulations, to deter non-compliance, and to assist in the detection of ML/TF in support of the efforts of the police and intelligence communities. FINTRAC's risk-based compliance program includes activities of increasing intensity across a range of options (see Figure 1 below). We focus our efforts on promoting awareness, providing assistance and conducting compliance assessments where they will be most effective, but may enforce penalties in the case of non-compliance.

View the text equivalent Figure 1 – FINTRAC compliance activities

Figure 1 – FINTRAC compliance activities

The graphic shows the awareness, assistance as well as assessment and enforcement compliance activities from low intensity to high intensity.

Awareness activities include: outreach and compliance assessment reports (CARs).

Assistance activities include: engagement, support, policy interpretations and money services business registry.

Assessment and enforcement activities include: CARs, observation letters, reporting entity validations, reports monitoring, compliance meetings, desk exams, onsite exams, follow-up exams, administrative monetary penalties and non-compliance disclosures.

Assessing non-compliance

In the normal course of our compliance activities, we identify instances of non-compliance with the Act and its regulations. We assess the severity of each non-compliance issue by understanding both the extent and the root cause of the non-compliance. Each non-compliance issue is assessed for its impact on FINTRAC's mandate and on the achievement of the objectives of the Act. To determine a suitable response to address a non-compliance result, we will consider the result in a holistic context, including other factors such as the RE's compliance history.

Addressing non-compliance

Following the completion of a compliance assessment, and depending on the extent of the non-compliance identified, FINTRAC may decide:

- to take no further action;

- to conduct follow-up compliance activities;

- to issue an AMP to encourage a change in behaviour; or

- to disclose relevant information to law enforcement for investigation and prosecution of non-compliance offences under the Act and its regulations.

Authority to issue an AMP

The following outlines the framework applicable when FINTRAC has decided that an AMP is the most suitable option to address a specific non-compliance result.

FINTRAC may issue an AMP and serve a notice of violation when it has reasonable grounds to believe that an RE has violated a requirement of the Act and its regulations.

AMPs are not issued automatically in response to non-compliance. AMPs are one tool that is available to FINTRAC and are used to address repeated non-compliant behaviour. AMPs may also be used when there are significant issues of non-compliance or a high impact on FINTRAC's mandate or on the objectives of the Act and its regulations. An AMP is generally used when other compliance options have failed.

Categories of violations

The Proceeds of Crime (Money Laundering) and Terrorist Financing Administrative Monetary Penalties Regulations (AMP Regulations) list the non-compliance violations that could be the basis of an AMP. The AMP Regulations categorize violations by degree of importance, and assign the following penalty ranges:

| Minor violation | $1 to $1,000 per violation |

| Serious violation | $1 to $100,000 per violation |

| Very serious violation | $1 to $100,000 per violation for an individual $1 to $500,000 per violation for an entity |

The limits above apply to each violation, and multiple violations can result in a total amount that exceeds these limits.

Criteria for determining an AMP amount

The Act and the AMP Regulations set out three criteria that must be taken into account when determining a penalty amount:

- The purpose of AMPs, which is to encourage compliance, not to punish (non-punitive);

- The harm done by the violation; and

- The RE's history of compliance.

We present the methods that we use to determine the penalty amount, along with the factors that we consider in our assessment when we issue an AMP.

FINTRAC will take a reasonable approach in the calculation of penalty amounts. We consider an AMP to be effective when the penalty amount is proportional to the harm done and prompts a change in behaviour toward future compliance. These amounts are in keeping with the type and extent of the violations, given the circumstances of each case.

The following guidelines are in place as benchmarks to assist FINTRAC officers in the calculation of a penalty amount, while taking into consideration the circumstances of each case. As a result, relevant mitigating factors will be carefully considered at each step and may reduce the actual penalty determined.

Step 1: Harm done assessment

FINTRAC defines “harm” as the degree to which a violation interferes with achieving the objectives of the Act (section 3, Act) or with FINTRAC's ability to carry out its mandate (section 40, Act).

The AMP Regulations classify all violations by degree of importance. They also determine the minimum and maximum penalty amounts for each level.

In assessing the harm done by a violation, FINTRAC considers both the potential and the resulting harm. “Resulting harm” means separate violations that come from the original violation. For example, when the compliance policies and procedures do not address how to report large cash transactions, the resulting harm is the unreported large cash transactions.

The first test to assess the harm done when calculating a penalty amount is to determine whether the reporting entity has completely failed to meet a requirement or only in part. For some violations, this is obvious; the requirement was met or it was not met. Other violations require further analysis. For example, when a client is not identified under the prescribed circumstances, the requirement is not met. When compliance policies and procedures are missing a component, the requirement is met in part.

When an RE has completely failed to meet a requirement, the base penalty amount that is typically considered for that violation is the maximum amount set out by the AMP Regulations. This is because completely failing to meet a statutory requirement is what interferes the most with achieving the objectives of the Act and FINTRAC's ability to fulfil its mandate.

When an RE has failed to meet part of a requirement, the base penalty amount determined for each violation depends on the part that is non-compliant and the extent of the failure. The extent of the failure is measured using assessment criteria that have been established based on the level of interference with achieving the objectives of the Act and FINTRAC's mandate.

Step 2: Compliance history and non-punitive adjustment

The second step in a penalty calculation looks at both the compliance history of the RE and the AMP's purpose, which is to encourage compliance, not to punish (non-punitive).

FINTRAC adjusts the penalty amount for each violation (determined in Step 1 above), based on whether or not the RE has previously been levied an AMP for the violation.

For a first-time violation, the penalty is typically reduced by two-thirds. For a violation occurring a second time (meaning that the RE had been penalized for this very same violation on a previous occasion), the penalty is typically reduced by one-third. For violations occurring a third time or more (again, meaning that the RE had been penalized for the same violation on two or more previous occasions), the full base penalty amount will typically be applied.

This second step in the calculation of a penalty demonstrates that the non-punitive criterion has been considered. We reduce the penalty amounts for the first two occurrences of a given violation. The full penalty amount is applied only after a specific violation has been committed for a third time.

Examples of a penalty calculation

Examples are available to illustrate the two-step penalty calculation.

AMP program – roles and responsibilities within FINTRAC

FINTRAC's AMP program is centralized at our headquarters in Ottawa. This helps to ensure policies and processes are applied consistently across the country and to maintain the required separation of duties between compliance assessment such as compliance examinations and enforcement. This approach also helps us monitor our program's effectiveness and allows us to quickly make policy and process improvements at the national level.

Following a compliance examination by FINTRAC regional offices located in Vancouver, Montreal and Toronto, we will review the findings to determine the most appropriate action to address the non-compliance. If the deficiencies and non-compliant behaviour justify an AMP consideration, the relevant regional office will make a recommendation, including the reasons, to headquarters. Upon receipt of the recommendation, headquarters undertakes an independent assessment of the findings and related information to determine whether we will proceed with an AMP.

AMP process

The AMP process begins with the issuance of a notice of violation and continues as outlined below:

Notice of violation

An RE subject to an AMP will receive a notice of violation that will include the following:

- The name and address of the RE that is subject to the AMP;

- The penalty amount;

- Payment instructions;

- Information on the right to make written representations to FINTRAC's Director and Chief Executive Officer (CEO), up to 30 days after receiving the notice of violation;

- Instructions on how to make representations to FINTRAC's Director and CEO, and where to obtain additional information on the AMP program;

- A list of the violations committed which will include the related legislative and regulatory provisions;

- The details of the penalty calculation, including the factors considered and the reasons; and

- A list of all the instances of the committed violations, including relevant references such as account numbers, transaction numbers, report numbers, etc.

A notice of violation must be issued no more than 2 years from the date when the non-compliance became known to FINTRAC.

In some cases, FINTRAC may exercise its discretion to offer to enter into a compliance agreement with the RE, which will include specific terms and conditions.

Payment of penalty

Upon receipt of a notice of violation, a person or entity can pay the penalty by completing the remittance form and submitting it with the payment in Canadian funds to:

FINTRAC

Finance Unit

24th Floor, 234 Laurier Avenue West

Ottawa, ON K1P 1H7

All payments of penalty amounts are to be made payable to the Receiver General for Canada. Payments can be made in the form of a certified cheque, money order, or bank draft.

If an RE pays the penalty indicated in the notice of violation, the RE is deemed to have committed the violations specified, and the AMP process ends.

Representations to FINTRAC’s Director and CEO

An RE may request a review of a notice of violation. This can be done by making written representations on the violations or the penalty or both at the same time, to the Director and CEO of FINTRAC, within 30 days of receiving the notice of violation.

If an RE requests a review, FINTRAC's Director and CEO will decide on the balance of probabilities whether the RE committed the violation or not; and may impose the penalty proposed in the notice of violation, a lesser penalty or no penalty. A notice of decision will be issued to communicate the Director and CEO's decision and the reasons behind it.

Failure to pay or make representations and notice of penalty

If you receive a notice of violation and do not pay or make representations to FINTRAC's Director and CEO within 30 days, the AMP process will end, the violations will be upheld and a notice of penalty will be issued.

Notice of decision and right of appeal

An RE that receives a notice of decision from FINTRAC's Director and CEO has 30 days to exercise its right of appeal to the Federal Court of Canada.

The AMP process ends when an RE pays the penalty imposed in the notice of decision, or does not appeal the Director and CEO's decision within 30 days.

Should the Director and CEO not issue a notice of decision within 90 days of receiving your representation for review, you may appeal the proposed penalty in Federal Court within 30 days.

Federal Courts

The Federal Courts have the power to confirm, set aside or change a notice of decision issued by FINTRAC's Director and CEO. As long as the AMP is before the Federal Court, the Federal Court of Appeal, or the Supreme Court of Canada, the AMP process is considered to be ongoing.

Public notice

FINTRAC must make public, as soon as feasible, the name of the RE, the nature of the violation or default, and the amount of the penalty imposed in the following cases:

- An RE pays the penalty issued in a notice of violation.

- An RE neither pays the penalty issued in a notice of violation nor makes representations to FINTRAC’s Director and Chief Executive Officer.

- An RE receives a notice of decision indicating that a violation has been committed.

- An RE enters into a compliance agreement with FINTRAC.

- An RE does not comply with a compliance agreement.

You can review the AMPs imposed by FINTRAC on the Public notice page.

Collection of penalties

The penalty amount is due 30 days after the notice of violation or notice of decision is received. Interest would begin to accrue on the day after the penalty was due. Any penalty that becomes payable is an outstanding debt to the Crown. FINTRAC will pursue outstanding AMP payments.

- Date Modified: